Source: Adobe Stock Image

Is Xero able to take on Intuit’s QuickBooks?

With Altium (ALU.ASX) being taken out,1 investors are left scrambling to fill in the gap to maintain its technology exposure. Whilst we won’t complain about a ~30% share price jump overnight, we also believe Renesas (6723.TYO) are taking away Altium’s long-term returns from investors in Australian markets. Altium is one of Australia’s highest quality listed technology companies, so now investors are looking enter positions or increase its allocation in other names. Most of the recognised quality names are already trading on high multiples. But high multiples don’t necessarily mean it should be avoided. Altium’s exit forward EV/EBITDA multiple is 50x and we are ruing the loss of it due to its growth potential.2 One company that recently got an uplift from this reallocation is Xero (XRO.ASX). Xero is a global SaaS company which offers its flagship Xero software, a cloud-based accounting system that connects SMEs to their tax advisors.

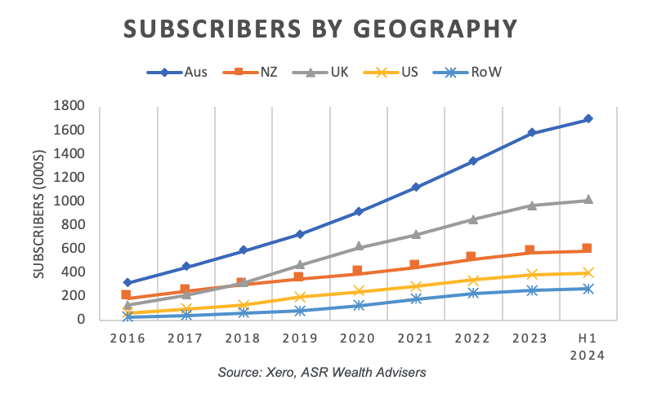

For full disclosure, this is a company we have recently held. We believe it is one of the highest quality tech companies of the ASX. It’s got high quality products and has demonstrated this by leveraging its success in New Zealand to effectively take over the Australian market. What’s just as impressive is that its subscriber growth is still in the mid-teens despite the relatively high penetration in the Australian market.3

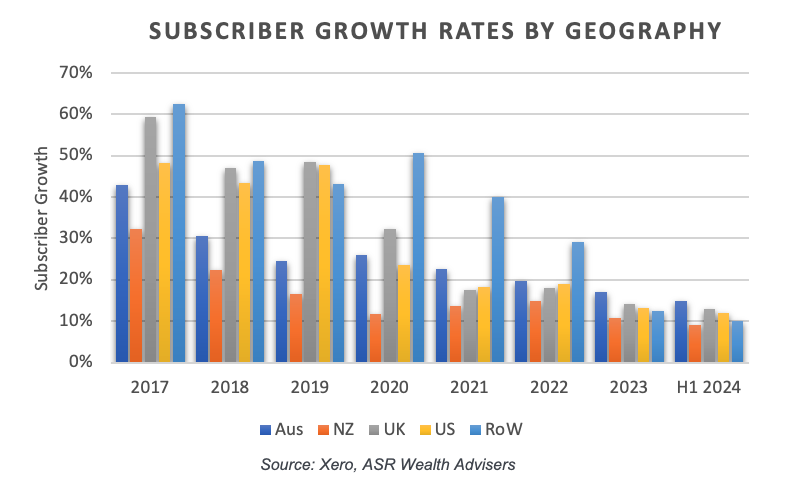

We could keep talking about why we like the business model, including its attractive unit economics, low churn rates, strong balance sheet, price and future cost levers, its capital light, as well as the tailwinds behind the cloud accounting industry. But what we are concerned about is that despite the solid subscriber growth in Australia, it shouldn’t be quicker than growth in the US. The US is coming from quite a low base, last reported to be 396,000, in comparison to Australia’s 1.69 million, in a much smaller market.4

In fact, subscriber growth in the US hasn’t been higher than Australia’s since FY19, when subscribers in the US increased from 132,000 to 195,000.5 Whilst the graph below obviously shows falling growth rates, this isn’t a large concern for many of the locations given the concept of scalable growth. Growth is going to taper back as scale increased. However, the graph above shows that the US hasn’t scaled, yet growth is dropping.

The reason why we are concerned is that solid growth in the US is priced into Xero’s valuation. Anyone who’s reverse engineered a Discount Cash Flow (DCF) would be able to see that that’s priced in. Given this, let’s take a closer look at the story in the US. It’s not necessarily Xero’s shortcomings, the problem is the incumbent. The incumbent is Intuit’s (INTU.NAS) QuickBooks.

We reiterate that Xero has a high-quality, scalable product, which has proven its quality in advanced markets such as Australia, New Zealand and the UK to an extent. It entered the US market with very competitive pricing, as well as strategies such as a paid referral system. Whilst blue sky ambitions would be to topple QuickBooks as the market leader, the huge total addressable market (TAM) and underpenetration in America’s complicated tax system was enough for this venture to be worthwhile even as a strong second.

After spending NZ$30m a year in the US, or NZ$300m over the past decade – What are the results? It has around 400,000 subscribers in the US.6 This is compared to 1 million in the UK and 2.3 million in ANZ. So how has Intuit been able to fend off Xero so far?

This starts with a history lesson. Its product Quicken was able to defeat Microsoft’s Money in the 90s and early 2000s.7 It’s no small feat being able to fend off Microsoft. Robbie Cape, who ran the Money business, stated that was very little to do with Intuit’s technology, and rather, it was Intuit’s prowess in consumer marketing and its ability to dominate retail channels.8 Intuit was ruthless with its focus its spending on marketing, but it didn’t waste its money. Intuit arguably has a competitive advantage in consumer insight, through its years long focus on direct consumer engagement which has been entrenched over time.9 Intuit has consistently been able to gain insights on the needs of consumers better than competitors. It’s not like Microsoft didn’t spend much, it had cash cows in its main products to fund the growth of Money, but its consumer insight just didn’t compare with Intuit’s. At the time, Bill Gates stated that Intuit had one of the best company cultures he’s seen.10 He came back and tried to compete with QuickBooks, but miserably failed.11 If you assume the company has kept its culture and its marketing edge, this appears to be a tough task for any competitor.

We believe that the market has underappreciated Intuit’s network effect, with its large share of SMEs, estimated to be at a massive 85%.12 Bookkeepers in the US are more likely to be already proficient in QuickBooks and SMEs know this.13 There isn’t a big incentive to learn a new software system, when you are more likely able to find bookkeepers or find business with the incumbent system, even if a competitor’s software system is somewhat better. Our view is that it would have to be substantially better to disrupt this network. Given this, bookkeepers generally refer it to SME clients. This acts as a friendly and costless referral channel. We do note that this is despite Xero offering referral fees.

Furthermore, we believe some have underestimated the challenges in leveraging overseas accounting software in the US. Whilst many SaaS companies are able to leverage its technology in a new market without a lot of product cost, it’s not as simple as this in this market. The US has a highly complex, state-by-state tax system.14

How complex is the tax system? The State of California couldn’t come up with its own successful system to assist in tax preparation when it tried. The father of Sam Bankman-Fried (founder of FTX), Joseph Bankman, created a pre-filled form system, which only ended up being taken up by ~20% of people.15 Whilst 20% might be good for a business in a state, that’s quite a failure for a state that intended this to be the de facto tax return system in that state. States such as Colorado, Maryland and Michigan have also tried and failed.16 Intuit’s core competency is to make complex tasks simple, and we believe it has a competitive advantage in its knowledge of the US tax system and developing products for it. So, it’s not as simple as launching a one size fits all software system in the US. There needs to be investment in developing software and attaining expertise in the state tax system of each state.

It is also important to understand how important established brand trust is in accounting service systems. We believe this brand trust that Intuit have is underappreciated. Tax season ends with Americans either receiving or writing their biggest cheque of the year, so there needs to be a lot of trust that this amount is accurate. Given this, we believe that Americans will tend to stick with the company they know and have built trust with, being QuickBooks.

Other than the product, Intuit itself has a size advantage. It is over 15 times the size of Xero and is growing its subscribers quicker than Xero, despite the higher base.17 18 Furthermore, its marketing spend is around a quarter of its revenue, in which at its size, it can completely outspend competitors to the point that it is somewhat of a moat. Comparing FY23 results, Intuit spent $3.76 billion on marketing on revenue of $14.37 billion (26.2% of revenue), as opposed to Xero spending $472 million on revenue of $1.5 billion (31.5% of revenue).19 20 Obviously, this isn’t just on accounting software in the US, but Intuit’s marketing spend is 2.5 times Xero’s total revenue, which puts the scale difference into perspective. As demonstrated previously, it spent the much larger Microsoft out of business in this segment, and it spent efficiently by leveraging its consumer insight expertise.

There are also other details we could get into, such as niche features including assisted tax preparation in a live video with an available accountant, or that 40% of customers are connecting other apps with QuickBooks through its ability to sync with apps.21

All said, subscriber growth in the US has been disappointing given the market potential and the marketing spend. Xero has continued to shift its go-to-market strategies and product development focus. It’s now focusing on small businesses with multiple jobs to be done and client advisory services and bookkeepers.22 The renewed narrow focus allows Xero to develop a strategy to somewhat specialise and capture some subscriber growth. However, this affects Xero’s potential operating leverage potential and may be an admission of lower growth ambitions. But focused growth may be good enough given how big the TAM is in the US. It’s important to note that Intuit believes its market penetration in SMEs is approximately 3.4%.23 This is due to the fragmented customer base in the US who are still on legacy tax return systems. The TAM is large and if Xero is able to increase its growth even without threatening Intuit, the pie is large enough for everyone to increase value and consider in the US a success.

However, if growth stays slow in the US, there may be pressure from investors to focus on profitability by increasing prices and decrease its spend, which may mark the end of significant growth ambitions in the US. Then there may be pressure to reallocate capital to other revenue generating opportunities in the rest of the world. However, we wouldn’t price in growth elsewhere as a replacement for the US as a given and not view this as a risk to its valuation. The question may then be asked if Xero should have spent a portion of this NZ$300 million over the past decade elsewhere.

In short, what we are trying to say is that there are a lot of scenarios that could occur due to the uncertain story in the US. Due to this, we’ve assigned a higher cost of capital to its valuation and created a wider range of scenarios in our operating model of it. This is the type of stock where we’d really need a margin of safety to account for the uncertainty, despite the fact that it is a high-quality company.

This piece was written by Tim Montague-Jones, Head of Research, and Sam Waldron, Equity Analyst, ASR Wealth Advisers Research Team.

Sources

1. ALU ASX announcement, 15 February 2024.

2. ALU ASX announcement, 15 February 2024.

3. XRO H1 FY24 Appendix 4D and Interim Report.

4. XRO H1 FY24 Appendix 4D and Interim Report.

5. XRO H1 FY24 Appendix 4D and Interim Report.

6. XRO H1 FY24 Appendix 4D and Interim Report.

7. https://www.cnet.com/culture/how-intuit-managed-to-hold-off-microsoft/

8. https://www.cnet.com/culture/how-intuit-managed-to-hold-off-microsoft/

9. Business Breakdowns – Intuit: An Operating System for Small Businesses.

10. Business Breakdowns – Intuit: An Operating System for Small Businesses.

11. https://www.cnet.com/culture/how-intuit-managed-to-hold-off-microsoft/

12. https://6sense.com/tech/small-business-accounting/quickbooks-market-share

13. https://www.amminvest.com/intuit-business-moat/

14. https://taxfoundation.org/research/all/state/2024-state-business-tax-climate-index/

15. https://www.washingtonpost.com/business/2024/02/13/states-tax-filing-experiments-failed/

16. https://www.washingtonpost.com/business/2024/02/13/states-tax-filing-experiments-failed/

17. XRO FY23 Annual Report, Appendix 4D and TCFD Statement.

18. Intuit Form 10-K.

19. XRO FY23 Annual Report, Appendix 4D and TCFD Statement.

20. Intuit Form 10-K.

21. https://www.intuit.com/

22. XRO H1 FY24 Appendix 4D and Interim Report, 9 November 2023.

23. https://yhamiltonblog.substack.com/p/agb-20232-intuit-intu

Disclaimer

This report has been prepared by Atlantic Pacific Securities Pty Limited trading as ASR Wealth Advisers ABN 72 135 187 085 (“ASRW”) CAR 339207 of Trilogy Group Australia Pty Ltd ABN 80 078 111 654 (“Trilogy”) AFSL 218770. ASRW is part of Amalgamated Australian Investment Group Limited ABN 81 140 208 288. Whilst the information presented herein is believed to be reliable and sourced from public sources thought to be reliable, ASRW does not make any representations as to its accuracy or completeness. This report is provided for informational purposes only. It is not an offer or a solicitation of an offer to buy or sell any financial products or to participate in any particular trading strategy. Any advice perceived to be included within this report is provided on a general advice basis only and therefore it does not take into account personal financial situation, objectives and needs of any individual. Before making any decision about financial products, investors must consider whether it is appropriate for them in light of their personal circumstances and seek professional investment, tax, legal and/or personal financial advice. Where applicable, investors should obtain and consider a Product Disclosure Statement, prospectus or other disclosure material relevant to the financial product before making a decision to acquire it.

ASRW’s, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Opinions, estimates and projections constitute the current judgement of the author as at the date of this report. They do not necessarily reflect the opinions of ASRW or any of their related entities, must not be seen as an endorsement in any way and are subject to change without notice. ASRW has no obligation to update, modify or amend this report or otherwise notify a recipient if any opinion, forecast or estimate contained herein changes or subsequently becomes inaccurate. Target prices are inherently imprecise and a product of the analyst’s judgement. Prices and availability of financial products are subject to change without notice and investment transactions can lead to losses as a result of price fluctuations, extreme volatility and other factors. If a financial product is denominated in a currency other than an investor’s currency, a change in exchange rates may adversely affect the investment.

Investing in financial markets involves risk and investments may go up and down. The payment of income and the return of capital are not guaranteed. Past performance is not an indicator of future results. Macroeconomic fluctuations often account for most of the risks associated with exposures to instruments that offer fixed or variable interest rates. Upside surprises in inflation, fiscal funding needs, and FX depreciation rates are among the most common adverse macroeconomic shocks that may impact the market value of any investment. Counterparty exposure, issuer creditworthiness, client segmentation, regulation, changes in tax policies, currency convertibility and settlement issues related to local clearing houses are also important risk factors to take into consideration.

The opinions and recommendations in the research report are based on a reasonable assessment by the research staff member who wrote the report using information provided by the product issuer and generally available in the market. ASRW’s research staff are well qualified and give their opinions and recommendations on reasonable grounds, and based on the information available to them. ASRW’s research staff are remunerated by salary and do not receive any commissions or fees. Annual bonuses may be paid on a discretionary basis and as relevant to their role. Employees and/or associates of ASRW, and related entities may hold one or more of the stocks, securities or investments reviewed in this report. Any personal holdings by employees and/or associates of ASRW, and related entities should not be seen as an endorsement or recommendation in any way. For information about ASRW, its financial services and Financial Services Guide, please visit www.asrw.com.au.