The push towards a net zero world has revitalised discussions about nuclear energy. Most of the world quickly lost interest in nuclear energy after the Fukushima disaster in 2011, which led the closure of uranium mines and a lack of investment in new ones. The economics just didn’t stack up at depressed uranium prices due to the lack of demand. However, investors didn’t predict the revitalisation of interest in this form of energy, which has led to a large and expanding supply gap.

Many countries have now realised that nuclear energy is needed to aid the ambitious clean energy targets, with many policy shifts by major countries. This caused a wave of sentiment, pushing spot prices up from US$50/lb in March 2023 to over $100 in January 2024.1 Whilst spot prices have dipped slightly to below $95, many would think that they have missed this uranium bull run. But we think this uranium market still has legs and in the Australian market, Boss Energy (BOE.ASX) is our pick.

Uranium in the nuclear energy supply chain

Uranium and Boss Energy’s role in the nuclear energy supply chain

To understand the uranium market, it is important to understand the role uranium plays in the nuclear energy supply chain. At Boss Energy’s two mines, uranium mined through in-situ leaching. This occurs when a leaching agent such as sulfuric acid is added to the uranium deposit, to dissolve it out to be extracted. This solution is refined into triuranium octoxide (U3O8), more commonly known as yellow cake, which is what is traded on uranium spot markets.2 BOE will either sell yellow cake on the spot market or to a utility company which has locked in a contract. This is BOE’s contribution to the supply chain.

How uranium fuels nuclear energy

It’s still worth knowing how the latter half of the supply chain works. Yellow cake is then converted into a gas (UF8) that is stored in cylinders, which is shipped to an enrichment plant. This needs to be enriched as only ~0.7% of yellow cake is U-235, which is the isotope used as fuel in nuclear reactors. It needs to be enriched by centrifuges to 3-5% to be used in reactors as fuel. It is then converted into powder and pressed into ceramic pellets which are loaded into fuel rods These fuel rods are bundled together to form a fuel assembly. Then the process of nuclear fission occurs, causing a chain reaction of atom splitting, which generates heat. Just like with coal and gas fired stations, the water is heated, creating pressurised steam which turns the turbine. This drives the generator, creating electricity. The difference is the source of heat, which is fuelled by uranium.3

Uranium prices – Why we believe there is upside

How big is the shortfall?

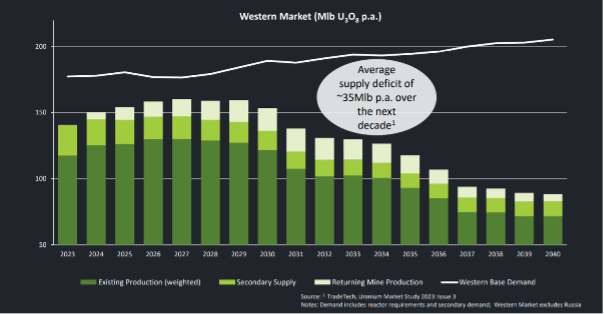

According to the World Nuclear Association, global yellowcake supply is estimated to be 145 million pounds (lbs) in 2024, whilst demand is 180 million lbs and predicted to nearly double to 300 million lbs by 2040.4 However, new mines take 10-15 years to develop, with most of the near-term pipeline being small idle mines which are being re-started. Due to this, the shortfall is expected to widen in the coming years.

Source: Paladin Energy

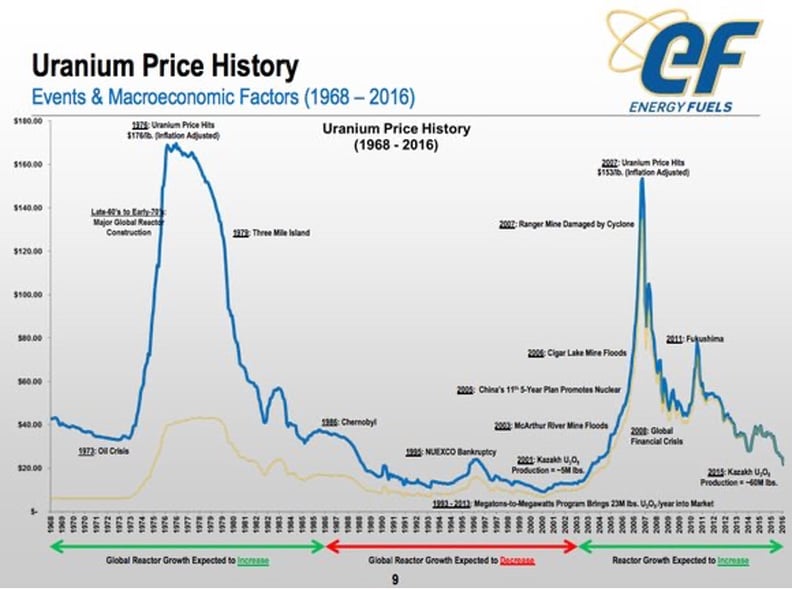

The yellow cake spot price is below US$100/lb, in which we believe it will increase above $100. In spikes back in the 1970s and the late 2000s, the inflation adjusted price peaked well above $200, as seen in the historic chart below. We’re not saying it will reach those levels, but we believe there is upside. To explore the shortfall, we look into what is driving demand and why the supply appears to be short.

Source: Energy Fuels

Demand – China, policy shifts and AI’s large energy usage

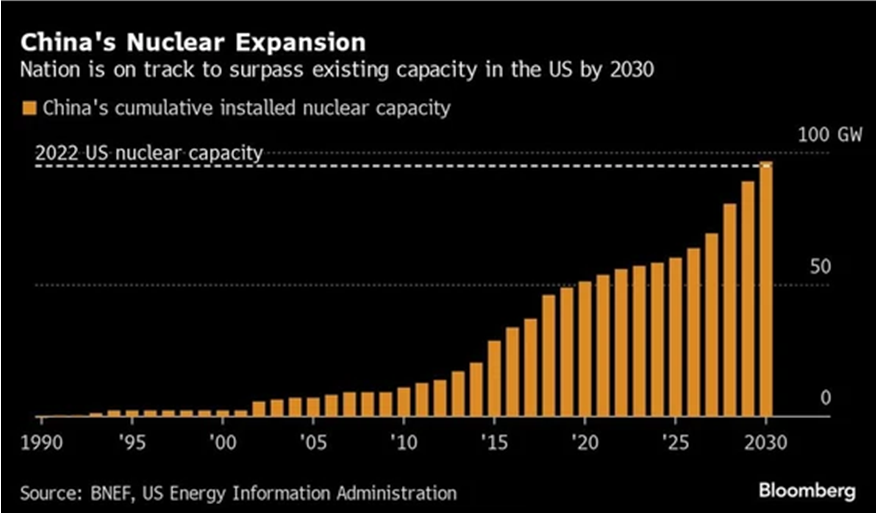

Demand for uranium is rapidly increasing, with the regeneration of idle mines and extensions in North America and Japan, as well as large amount of new builds in China. There are over 400 reactors in operation.5 Over 60 reactors are under construction globally, with approximately half of them being built in China.6 China has a big incentive for it to meet clean energy targets and lower its pollution through nuclear energy. The country has a plan to quadruple nuclear capacity by 2050. China’s reactor buildout is a big part of the demand dynamic and a key support for uranium demand. China’s nuclear power companies hold a lot of cash and are cash flow positive, with much of its profit being impacted by depreciation, which doesn’t actually affect cash flows. Furthermore, China’s power companies have demonstrated its ability to meet time targets more efficiently, under pressure to meet targets set by the government. Furthermore, it is less affected by sentiment and the flow of capital due to state controls.

Source: BNEF, US Energy Information Administration, Bloomberg

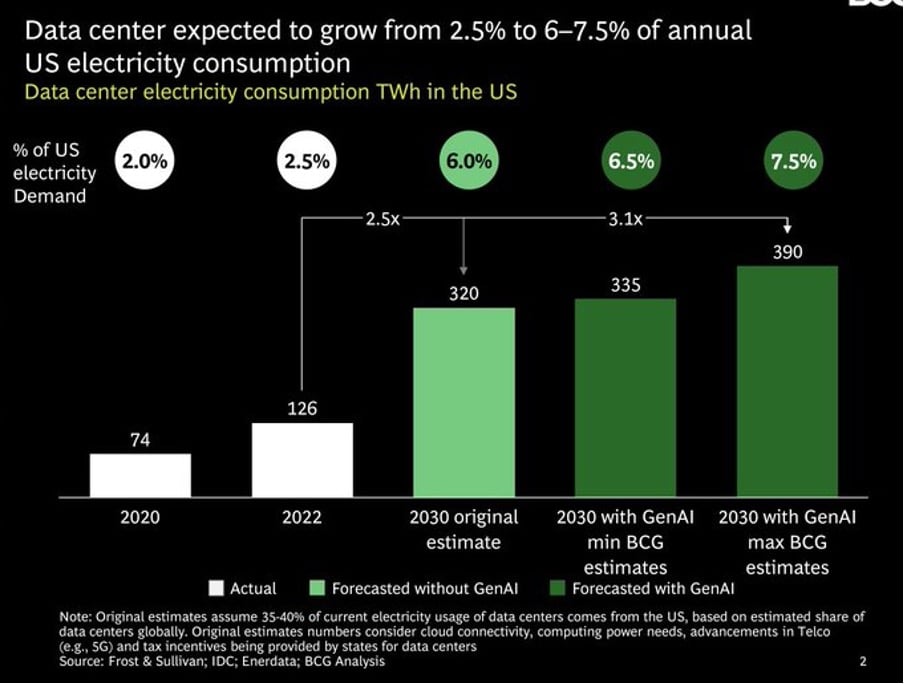

Outside of China, 22 countries pledged to triple nuclear energy by 2050 at a summit in 2023. This includes the US, Canada, France, Japan and the UK.7 The sentiment to nuclear has been changing, with governments changing policy to promote nuclear, and capital flowing in. What has also been underestimated is the fact that AI is a huge user of electricity, with some estimates indicating that US data centre power is expected to triple by 2030, the equivalent of powering 40 million US homes, as seen in the graph below. With the shift away from fossil fuels, nuclear energy can contribute to clean energy. However, nuclear reactors are capital intensive and it takes a long time to build and expensive. Whilst the sentiment is there, there is a risk of dislocation between expectations of nuclear reactors coming online and the reality. This is the downside risk from the demand perspective.

Source: Frost & Sullivan, IDC, Enerdata, BCG Analysis

Risks to demand

The biggest risk is the black swan event that a nuclear incident occurs. The technology has improved and the world has learned from Fukushima. The more prominent risk is that the market has overestimated demand, particularly if there are less new builds than expected, small modular reactors don’t take off and project delays.

Kazatomprom’s production could disappoint, putting upwards pressure on prices

Kazakhstan based Kazatomprom (KAP) and US based Cameco make up approximately half of global uranium production, so any upgrade or downgrades in production affects global supply and spot prices. KAP announced a 9.3 million lb downgrade in production expectations for 2024, or 14% of production, which affected uranium prices.8 Whilst this has been priced in, we believe there is a possibility that there will be a downgrade for production in 2025. This is potentially a key catalyst. KAPs stated reason for the production miss was difficulty in sourcing sulfuric acid, which is used in the extraction process. However, its current production guidance for 2025 implies this issue is resolved and KAP will have usual sulfuric acid supplies, but the company didn’t state how.

If the company does have difficulty in securing enough sulfuric acid, this could result in another production downgrade. This would result in KAP buying uranium on contracts closer to spot prices to make up for the production shortfall to meet contracted sales, as contracts have to be filled. This would put upwards pressure on spot prices. It also appears that its inventory level is below its inventory targets of 40-70% of sales, which means restocking may be necessary.

In its earnings report, the company implied that existing production is depleting and new production is delayed to the point of being below the threshold of ~20% of subsoil user agreements.9 This is in contrary to its target of reaching above ~10%. The stated lack of sulfuric acid procurement could actually indicate that KAP needs above normal levels of the acid for its assets, indicating ageing assets.

Supply is slow to react – It takes over a decade to build a uranium mine

Whilst supply usually reacts to higher commodity prices, it will take a very long time for supply to come online. New uranium mines take 10-15 years to be built and start producing at nameplate capacity, and there haven’t been many new mines being built over the last few decades due to nuclear incidents, especially since Fukushima.10 These nuclear incidents have heavily capped demand, resulting in a consistent oversupply of uranium, leading to a lack of new mines and in fact, many mine closures.

Due to this, most of the supply coming online in the short to medium term is restarting idle mines which were mothballed after previous falls in uranium prices. The issue is, there are not enough idled mines to drastically reduce the shortfall, so if demand keeps increasing, the shortfall could only feasibly be reduced by new mines. Many of these idle mine restarts still experience delays, such as Cameco needing to replace old equipment and capital from when it was previously in operation. This further delays supply. There have been numerous other cases of this occurring, such as a potential delay of production at Orano, with delays 7 million lbs of production a year. We expect more delays around the world.11

Other supply dynamics – A trust which is buying up and storing supply

An interesting wildcard is the Sprott Physical Uranium Trust (SPUT), which is an investment vehicle that investors can put money into to get uranium exposure. SPUT has been buying up supply as more capital flows into it, with it accumulating approximately 63 million pounds (lbs) as of the start of 2024.12 As long as money keeps flowing into it, this demand will push up prices as it takes supply off the market as the uranium is stored rather than used as fuel. However, there is a risk if SPUT dumps uranium into the market and causes an oversupply, which it says it won’t. This remains a key risk.

Boss Energy is our uranium pick

Out of the uranium miners listed on the ASX, we prefer Boss Energy. It operates the Honeymoon uranium project in South Australia, which is fully licenced for exports. It also has a 30% stake in Alta Mesa in South Texas in the US, paying $60 million for it.13 We like that BOE’s assets are in the safe jurisdictions of Australia and the US, as opposed to the other major uranium miner on the ASX, Paladin Energy, which operates a mine in Namibia. Namibia is a very unfavourable jurisdiction for operations. It is a one-party socialist state, which results in a higher risk that the government seizes assets than a liberal democracy. In fact, there were reports that the government was considering nationalising Paladin’s mine, which the government denied.14 However, this highlights the risk that this decision could be revisited, especially once Paladin starts producing at capacity.

BOE’s Honeymoon asset is a solid asset, with an expected mine life of 10 years. After the restart of production in 2024, the company will focus on expansion studies on potential satellite deposits. Initial capacity is 2.5 million lbs per annum, with a study on whether this can be increased to 3.3 million lbs and extending the mine life to 15 years.15 The all in sustainable cost is $25-30/lb.16 BOE doesn’t have any debt and is sitting on a few hundred million in cash which it can use for exploration studies, as well as giving it a capital buffer.

The Alta Mesa asset is also a restart project, which restarts in the first half of 2024. The initial capacity is 1.5 million pounds, of which BOE claims a 30% share, with an all in sustainable cost of $35/lb.17 With its mine lives, the aggregated measured and indicated resource for the projects that BOE has a share in is 40 million pounds for 10-15 years of production. We like that both mines use in-situ extraction, which results in no ground excavation, tailings and typically is lower cost and uses lower capex than conventional mines.

With BOE investing heavily in FY24 through acquiring a stake in Alta Mesa and seeing peak capex spend for the Honeymoon restart, BOE will start generating solid free cash flows from FY25 as it ramps up production and cycles capex. If uranium demand continues, we expect BOE will look to acquire further assets to extend the company’s production outlook.

The investment entry point price setup

Uranium spot prices pulled back below US$100/lb, which was a major catalyst for BOE shares to fall over 20% from its peak over a month prior. The price downturn was largely caused by a trading event which caused prices to spike then fall.

Traders and hedge funds bet that Cameco would downgrade 2024 production guidance. If this occurred, this would have resulted in Cameco buying more uranium on contracts closer to spot market prices to meet its sales contracts, which would put upwards pressure on spot prices due to Cameco’s size. As the market anticipated this, uranium spot prices pre-emptively increased due to this speculation.

However, Cameco announced solid production guidance, which means the company would need to buy less in the spot market than some anticipated, resulting in the price decreasing as speculators exited their positions.18 This resulted in spot prices decreasing to a slightly less speculative level and an opportune entry point, given our analysis of the potential upside due to the supply shortfall.

Disclaimer

Sources

1. https://www.cameco.com/invest/markets/uranium-price

2. https://world-nuclear.org/nuclear-essentials/how-is-uranium-made-into-nuclear-fuel.aspx

3. https://world-nuclear.org/nuclear-essentials/how-is-uranium-made-into-nuclear-fuel.aspx

4. https://www.mining.com/uranium-sector-scrambling-to-fill-supply-gap/

5. https://www.statista.com/statistics/267158/number-of-nuclear-reactors-in-operation-by-country/

6. https://world-nuclear.org/information-library/current-and-future-generation/plans-for-new-reactors-worldwide.aspx

7. https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/electric-power/120223-cop28-22-nations-pledge-to-triple-nuclear-generation-capacity-by-2050

8. Kazatomprom announcement.

9. Kazatomprom announcement.

10. https://www.iaea.org/newscenter/news/uram-2018-ebb-and-flow-the-economics-of-uranium-mining

11. https://www.mining.com/web/frances-1-6-billion-uranium-deal-with-mongolia-faces-delays/

12. https://au.investing.com/news/stock-market-news/hedge-funds-betting-big-on-uranium-as-spot-price-surges-to-16year-highs-3074496

13. Boss Energy announcement.

14. https://www.afr.com/companies/mining/paladin-assurance-on-uranium-mine-nationalisation-20230531-p5dcrl

15. Boss Energy announcement.

16. Boss Energy announcement.

17. Boss Energy announcement.

18. Cameco announcement.

Disclaimer

This document has been prepared by Atlantic Pacific Securities Pty Limited ABN 72 135 187 085 trading as ASR Wealth Advisers which is a Corporate Authorised Representative No 339207 of Trilogy Group Australia Pty Ltd ABN 80 078 111 654 (Trilogy) AFSL 218770. ASR Wealth Advisers (ASRW) is part of Amalgamated Australian Investment Group Limited ABN 81 140 208 288 (AAIG).

This document is provided for information purposes only. Any advice perceived to be included within this document is provided only on a general advice basis and therefore it does not take into account financial situation, objectives and needs of any person. The information herein is not intended or to be construed as an offer, solicitation or a recommendation for any financial product. Before making any decision about financial products, investors must consider whether it is appropriate for them in light of their personal circumstances and seek professional investment, tax, legal and/or personal financial advice. Where applicable, investors should obtain and consider a Product Disclosure Statement, prospectus or other disclosure material relevant to the financial product before making a decision to acquire it. Whilst the information contained herein is believed to be reliable and collected from trusted public sources, neither Trilogy, nor ASRW, nor their related entities make any representations as to its accuracy or completeness. ASRW’s publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Opinions, estimates and projections constitute the current judgement of the author as at the date of this document. They do not necessarily reflect the opinions of Trilogy, ASRW or any of their related entities and are subject to change without notice. ASRW has no obligation to update, modify or amend this document or otherwise notify a recipient if any opinion, forecast or estimate contained herein changes or subsequently becomes inaccurate.

Investing in securities involves risks, including loss of some or all capital. The payment of dividends and the return of capital are not guaranteed. Past performance is not necessarily indicative of future results. Forward-looking statements involve known and unknown uncertainties and other factors, and reliance should not be placed on such statements. Target prices are inherently imprecise and a product of the analyst’s judgement. Prices and availability of financial instruments are subject to change without notice and investment transactions can lead to losses as a result of price fluctuations, extreme volatility and other factors. Upside surprises in inflation, fiscal funding needs, and FX depreciation rates are among the most common adverse macroeconomic shocks that may impact the market value of any investment. Counterparty exposure, issuer creditworthiness, client segmentation, regulation, changes in tax policies, currency convertibility and settlement issues related to local clearing houses are also important risk factors to take into consideration. Unless otherwise indicated, prices are current as of the end of the previous trading session, and sourced from local exchanges via Bloomberg, IRESS, ASX or other vendors.

The opinions and views contained herein are based on a reasonable assessment by the research staff member who wrote this document using information provided by the product issuer and generally available in the market. ASRW research staff are remunerated by salary and do not receive any commissions or fees. Annual bonuses may be paid on a discretionary basis and as relevant to their role. Employees and/or associates of ASRW and its related entities may hold one or more of the securities reviewed in this document. Any personal holdings by employees and/or associates of ASRW and its related entities should not be seen as an endorsement or recommendation in any way.