Despite InvoCare being delisted, we believe the remaining funeral business on the ASX is a better company that offers more value.

When writing a letter to Jean-Baptiste Le Roy, Benjamin Franklin famously said, “but in this world, nothing can be said to be certain, except death and taxes.” Whilst it may be a grim topic, the death care industry plays an important role in our lives, by providing a final farewell to loved ones.

Due to the necessity of funerals and cremations, this actually results in quite consistent underlying demand over the long-term, which is growing as the population increases and is also ageing in countries such as Australia and New Zealand. ABS data shows that death volumes are expected to increase from just under 1% from 1990-2019 to 2.5% from 2023-2030 and 2.9% from 2031-2040. This is a solid increase in underlying volumes for the funeral industry.

With InvoCare being taken out by private capital, this leaves Propel Funeral Partners (PFP.ASX) as the main exposure to this industry. Propel has 192 operating locations in Australia and New Zealand, including owned and leased funeral homes, cremation facilities and cemeteries. The company traditionally had a heavily regional tilt to its geographic locations, but now it has moved more to an even split, as there are more people in the capital cities and urban areas. Whilst InvoCare is much more well known, Propel could actually be a better alternative to its larger peer. Whilst the underlying death volume growth figures aren’t exhilarating, this company is set to grow earnings much quicker through consolidating the fragmented industry, as well as through price rises.

Defensive business with pricing power

Looking at the underlying business, Propel has demonstrated its pricing power by being able to consistently raise funeral prices over time, which has been slightly over 3% in the past decade. This shows Propel’s ability to offset general inflation. However, Propel has demonstrated its ability to raise prices higher than this average level during a higher inflation period, which is what we have recently experienced. In FY23, Propel increased comparable net average revenue per funeral (ARPF) by 7%, which excludes additional funeral homes acquired during the period. This helped offset rising material and labour costs.

Propel’s gross average revenue per funeral (ARPF) is approximately $8,600, which is lower than InvoCare’s last publicly reported figure of approximately $9,200, which has likely increased since then. A lot of the businesses that Propel have acquired from small mum and dad operators haven’t systematically increased prices, so this arguably gives Propel more of a scope to increase prices in the long-term. However, do not expect sudden price increases in the short-term to make up for this, as Propel and other businesses aren’t seeking to price gouge.

Propel has this pricing power to maintain parity with inflation as consumers don’t tend to shop around and bargain for funerals or cremations as long as prices are reasonable, given this is one of the final acts they do for a loved one. This is also why a funeral business is defensive, as it is needed regardless of the state of the economy.

Well positioned to successfully execute a roll up strategy in a fragmented market

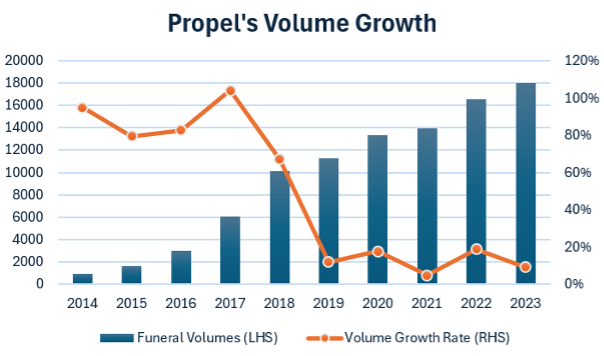

Despite the steady underlying growth, the real growth is from acquiring smaller, independent operators in a highly fragmented market. As you can see below, Propel’s volumes are growing at a much higher rate than historical deaths growth in Australia and New Zealand, even currently at its larger scale. This shows the role of acquisitions in its volume growth.

Source: Propel Funeral Partners, ASR Wealth Advisers

InvoCare has approximately 21% in market share, Propel has 9% and the rest of the market are made up on small mum and dad operators. InvoCare is seen to have potentially too much concentration in some markets, whereas the small operators are the takeover targets. This puts Propel in the sweet spot to acquire smaller businesses and consolidate with a lower likelihood of the ACCC stepping in.

By making frequent strategic acquisitions, the company is able to expand its economies of scale, bringing about business efficiencies through shared central services which cuts down operating costs, as well as gain more bargaining power with suppliers. Averaging a cash conversion rate of 99%, these businesses are cash generating businesses which helps with the balance sheet. The company uses the cash on its balance sheet, raises debt, or raises equity to fund these acquisitions. The company has raised equity twice since its IPO, with an average discount of just ~4%, and it has been heavily oversubscribed both times.

Disciplined M&A with a focus on fostering relationships

Propel is quite disciplined with its M&A, usually buying businesses at 4-6x EBITDA post rent, then paying market value on the property. When including the property value, this is usually at 8-9x EBITDA, which is below Propel’s EV/EBITDA. Propel tends to build relationships with smaller operators of many years, and buy companies when the time is right, usually without competitive bidding. Small funeral operators tend to be family businesses which has been handed down through generations, and they are generally sceptical of private capital, whereas Propel is seen as an industry participant.

It has proven it will look after the legacy of the businesses by running a decentralised system and keeping the fabric of these small businesses as it is, just with additional improvements and benefits from being a part of a larger company. Propel also tends to leave the brand of the acquired business, and keep staff and management on board, which makes the process more ideal for the small business owners. The company deploys an average of $40-50 million in capital, so with its current balance sheet this M&A activity is covered for approximately four years.

Reputational and time barriers to entry

These acquired businesses usually have established a reputation over many decades and even over a century, so although there aren’t financial barriers to entry, there are some competitive and time barriers. It can take many years to setup a business such as a crematorium for example, and it may then take a while to get customers over well-established competitors in the area.

Founder led business

The current CEO, Albiin Kurti, and the current Executive Director and Head of M&A and General Counsel, Fraser Henderson, are the co-founders of the business. The business is founder led, with management very incentivised to grow shareholder value and improve its own business. The non executive directors also have significant share holdings of the company. We value businesses where its executives are aligned with the growth of the business.

Valuation and comparison to InvoCare

With its major competitor and comparable InvoCare being acquired in 2023, it allows for a comparison over market multiples and valuation. InvoCare got acquired for a forward EV/EBITDA multiple of 17.5x (enterprise value of $2.18 billion on forecasted FY23 EBITDA of $125 million). Propel is trading at forward EV/EBITDA of 12.5x. This is relevant as Propel has announced that there have been unsolicited bids made for the company recently.

Propel has had much higher top and bottom line growth rates than InvoCare, due to its smaller scale and higher scope for M&A activity as it is not as restricted from an anti-competition point of view. Propel also runs a leaner operation, with EBIT margins in the high teens or low 20s, compared to mid to low teens at InvoCare. Propel has a much more decentralised model, where general managers of the smaller brand report straight to the CEO, with a small central office. Propel doesn’t have middle management such as regional managers. InvoCare’s head office is approximately ten times larger, and invests in technology to create efficiencies, where there is debate as to whether this is effective or not.

Propel doesn’t invest in a tech stack as it keeps its business simple. Furthermore, during a period when InvoCare’s market share decreased from 25% to 21%, Propel’s increased from 1% to 9%. Business momentum is clearly on Propels side. InvoCare also was unable to handle volumes after Covid-19 lockdowns due to labour shortages, which is something Propel didn’t experience, and actually benefitted due to the latent capacity at funeral homes which it was able to ramp up for increased demand. InvoCare also faced criticism for its $200 million capital expansion program to upgrade its facilities under its ‘protect and grow’ strategy.

We do acknowledge that InvoCare got acquired at a generous multiple by private equity, likely seeing opportunities to strip out costs and create efficiencies. However, private equity pounced when the stock was beaten up, and the day before the bid was announced, InvoCare was trading at a forward EV/EBITDA multiple of 13x. This is still above Propel’s forward multiple, despite being a higher growth, higher margin business, which is gaining market share as opposed to losing it, and isn’t embarking on inefficient spending programs.

Propel’s trading at a discount to its peer even at its beaten up pre-acquisition value, despite running a better operation. Even without a multiple expansion from market recognition or a future potential takeover offer, we believe Propel will continue to expand its earnings to drive value. Let’s not forget that Propel has ~$215 million in land and buildings on its balance sheet, reported at cost. The ~$110 million in land value is likely worth more, given the trajectory of land values in Australia. The book value of its land and buildings is approximately 30% of market cap, so you’re essentially paying just over $500 million for the business operation, ex land and building book value.

This piece was written by Tim Montague-Jones, Head of Research, and Sam Waldron, Equity Analyst, ASR Wealth Advisers Research Team.

References

- Propel Funeral Partners.

- Propel Funeral Partners ASX announcements.

- InvoCare ASX announcements.

- Iress.

Disclaimer

This document has been prepared by Atlantic Pacific Securities Pty Limited ABN 72 135 187 085 trading as ASR Wealth Advisers which is a Corporate Authorised Representative No 339207 of Trilogy Group Australia Pty Ltd ABN 80 078 111 654 (Trilogy) AFSL 218770. ASR Wealth Advisers (ASRW) is part of Amalgamated Australian Investment Group Limited ABN 81 140 208 288 (AAIG).

This document is provided for information purposes only. Any advice perceived to be included within this document is provided only on a general advice basis and therefore it does not take into account financial situation, objectives and needs of any person. The information herein is not intended or to be construed as an offer, solicitation or a recommendation for any financial product. Before making any decision about financial products, investors must consider whether it is appropriate for them in light of their personal circumstances and seek professional investment, tax, legal and/or personal financial advice. Where applicable, investors should obtain and consider a Product Disclosure Statement, prospectus or other disclosure material relevant to the financial product before making a decision to acquire it. Whilst the information contained herein is believed to be reliable and collected from trusted public sources, neither Trilogy, nor ASRW, nor their related entities make any representations as to its accuracy or completeness. ASRW’s publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Opinions, estimates and projections constitute the current judgement of the author as at the date of this document. They do not necessarily reflect the opinions of Trilogy, ASRW or any of their related entities and are subject to change without notice. ASRW has no obligation to update, modify or amend this document or otherwise notify a recipient if any opinion, forecast or estimate contained herein changes or subsequently becomes inaccurate.

Investing in securities involves risks, including loss of some or all capital. The payment of dividends and the return of capital are not guaranteed. Past performance is not necessarily indicative of future results. Forward-looking statements involve known and unknown uncertainties and other factors, and reliance should not be placed on such statements. Target prices are inherently imprecise and a product of the analyst’s judgement. Prices and availability of financial instruments are subject to change without notice and investment transactions can lead to losses as a result of price fluctuations, extreme volatility and other factors. Upside surprises in inflation, fiscal funding needs, and FX depreciation rates are among the most common adverse macroeconomic shocks that may impact the market value of any investment. Counterparty exposure, issuer creditworthiness, client segmentation, regulation, changes in tax policies, currency convertibility and settlement issues related to local clearing houses are also important risk factors to take into consideration. Unless otherwise indicated, prices are current as of the end of the previous trading session, and sourced from local exchanges via Bloomberg, IRESS, ASX or other vendors.

The opinions and views contained herein are based on a reasonable assessment by the research staff member who wrote this document using information provided by the product issuer and generally available in the market. ASRW research staff are remunerated by salary and do not receive any commissions or fees. Annual bonuses may be paid on a discretionary basis and as relevant to their role. Employees and/or associates of ASRW and its related entities may hold one or more of the securities reviewed in this document. Any personal holdings by employees and/or associates of ASRW and its related entities should not be seen as an endorsement or recommendation in any way.