Source: Adobe Stock Image

Dividend reinvestment plans (DRPs) are a popular investment strategy used by many investors to maximize their returns.

What is a dividend reinvestment plan?

Dividend reinvestment plans (DRPs) are investment plans that allow investors to reinvest their dividend payouts into additional shares of a company's stock. Essentially, instead of receiving cash payouts from the company, investors receive additional shares of stock. DRPs are offered by many publicly traded companies on the ASX, and they are often available to investors free of charge.

The way DRPs work is simple. Investors who enrol in a DRP program will receive additional shares of stock based on the amount of the dividend payout. For example, if a company pays a dividend of $1 per share, an investor who owns 100 shares of that company's stock would receive $100 in cash. However, if that same investor was enrolled in the company's DRP program, they would receive an additional 1 share of stock for each share they own, effectively reinvesting the $100 into the company's stock. The number of additional shares received is based on the prevailing market price of the stock at the time of the dividend distribution, so the exact number of shares received by the investor may vary.

The benefits of dividend reinvestment plans

The benefits of DRPs are numerous. First, they allow investors to reinvest their dividend payouts, which can help them grow their investment portfolio over time. By reinvesting their dividends, investors can purchase additional shares of stock without incurring additional transaction fees, which can be expensive over the long term. Additionally, DRPs can help investors accumulate wealth faster because they are compounding their returns. As the value of the company's stock increases over time, the additional shares acquired through DRPs will also increase in value.

Another benefit of DRPs is that they can help investors avoid the temptation to spend their dividend payouts. Many investors who receive cash dividends may be tempted to use the money for non-investment purposes, which can hinder their ability to achieve their financial goals. By reinvesting their dividends through DRPs, investors are able to avoid this temptation and keep their money working for them.

Dividend reinvestment plans and the benefits of compounding

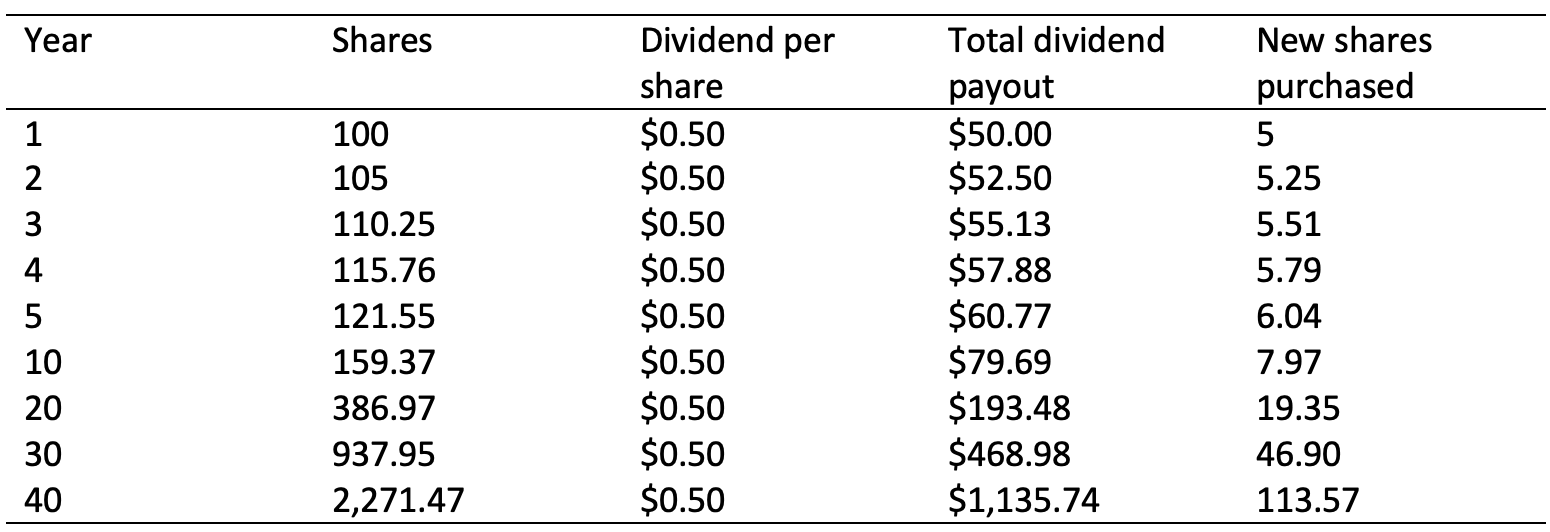

The compounding effect of DRPs can be illustrated using a hypothetical example. Let's say that an investor bought 100 shares of a stock for $10 per share, for a total investment of $1,000. The stock pays an annual dividend of $0.50 per share, which amounts to a total annual dividend payout of $50.

If the investor chooses to reinvest their dividends through a DRP, they would receive an additional 5 shares in the company (assuming the stock is trading at $10 per share) instead of the $50 cash payout.

In year 2, assuming the stock price remains the same, the investor would receive another $50 in dividend payouts. However, this time they would receive a payout based on their new holding of 105 shares, for a total dividend payout of $52.50. Again, assuming the investor reinvests this payout through the DRP, they would receive another 5.25 shares in the company.

This cycle continues year after year, with the investor receiving increasingly larger dividend payouts based on their growing number of shares in the company. The chart below illustrates how the compounding effect of DRPs can lead to significant growth in an investor's holdings over time.

As you can see, over a period of 40 years, the investor's initial investment of 100 shares has grown to over 2,200 shares, solely due to the compounding effect of reinvesting dividends through a DRP. This is an increase of over 2,100% in their holdings, compared to an increase of only 100% if they had simply held onto their initial 100 shares without reinvesting their dividends.

How to take part in a dividend reinvestment plan

To take part in a dividend reinvestment plan (DRP) for a company listed on the Australian Securities Exchange (ASX), you typically need to follow these steps:

1. Check if the company offers a DRP: Not all ASX-listed companies offer DRPs. You can check the company's website, ASX announcements or financial reports, or contact the company's investor relations department to find out if they have a DRP.

2. Register for the DRP: If the company offers a DRP, you need to register for it. You can typically do this through the company's share registry or by contacting the registry provider (e.g. Computershare). The registry provider is the company that maintains the company's shareholder register and manages the DRP.

3. Choose your participation level: Once you've registered for the DRP, you need to decide how much of your dividend payments you want to reinvest. Some companies allow you to reinvest all your dividends, while others have a minimum or maximum level of participation. You can also choose to participate in the DRP for some shares and receive cash dividends for others.

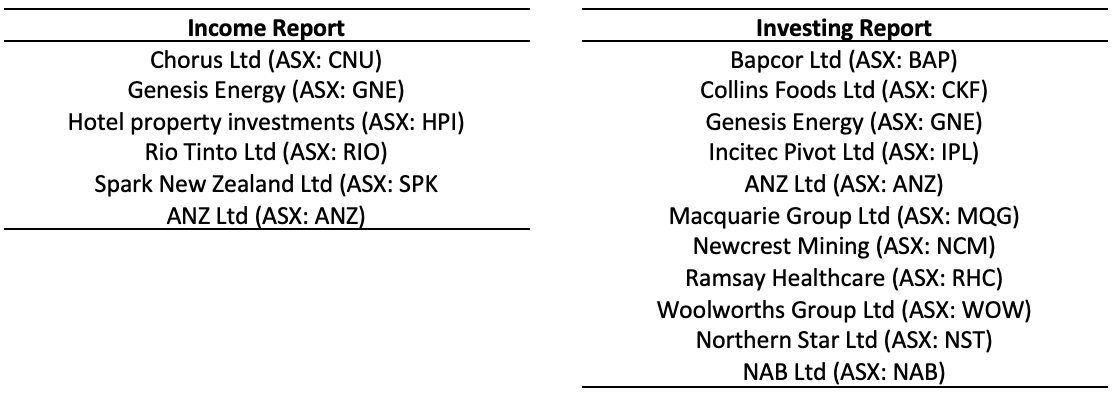

Companies that we cover that currently have a dividend reinvestment plan

Additionally, aside from the positions listed above, a selection of the ETFs currently listed on the ETF report also have a dividend reinvestment plan option.

In summary, dividend reinvestment plans are a popular investment strategy used by many investors. They allow investors to reinvest their dividend payouts into additional shares of a company's stock, which can help them grow their investment portfolio over time. As with any investment strategy, investors should carefully consider their financial goals and risk tolerance before deciding whether to enroll in a DRP program.