Many of you would have witnessed the banking instability over recent weeks, with UBS’ acquisition (or merger, depending on whom you ask) of Credit Suisse (CS) being a striking event in the history of the global banking system. On Monday, UBS agreed to a CHF 2 billion (US$3 billion) acquisition of Credit Suisse, paying shareholders 1 UBS share for every 22.48 shares they owned in Credit Suisse.1 This was a massive discount for UBS and a significant loss for any pre-existing CS shareholders. In recent years, Credit Suisse had been hit with a wide array of scandals driven largely by corporate mismanagement, with the nail in the coffin coming last week. CS suffered the double-whammy of a tumbling stock value and a mass exodus of customer deposits – particularly in the wealth management division. With Credit Suisse being considered a “systemically important bank” by the Swiss Financial Market Supervisory Authority (FINMA), the financial regulator forced UBS to buy CS to prevent its collapse and the contagion risk this would bring to both the European and global financial system.2

What’s different about this takeover?

There were several key takeaways from this acquisition. These include: no shareholder approval being required from either bank, UBS inheriting CHF 166 billion in customer deposits, combined assets under management for UBS now equating to ~US$ 5 trillion and, importantly, there was a write-down to zero of Credit Suisse’s AT1 bonds worth CHF15.8 billion.

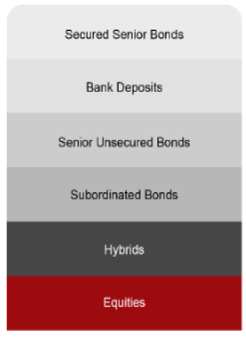

CS’s AT1 bonds being written down to zero by FINMA was particularly strange as ordinary equity holders received compensation in the acquisition. Normally in a bail-out scenario, AT1 bondholders would receive a preferential payout to shareholders as they sit higher up within the bank’s capital structure. In this acquisition this was not the case, with shareholders receiving a total of CHF 3 billion, whilst AT1 or hybrid holders received no compensation in a direct violation of the Basel III accords that all major banks adhere to.3

The standard bank capital structure and Basel III

The diagram below shows a bank’s standard capital structure. At the bottom, you have equity holders (the least preferred of the bank’s liabilities), then moving upwards in order of importance, you have hybrids (AT1), subordinated bonds, senior unsecured bonds and bank deposits, with the most preferred of the bank’s liabilities being senior secured bonds. The structure denotes the order in which dividends/distributions are paid, and in the event of a wind-up, the capital holders who take precedence in receiving some, or all, compensation for the value of their investment. The key observation is that the hybrids sit above equity in preference and should have received preferential treatment in the takeover but did not.

Source: https://www.livewiremarkets.com/wires/high-yield-returns-from-aussie-bank-bonds-2023-03-03

Source: https://www.livewiremarkets.com/wires/high-yield-returns-from-aussie-bank-bonds-2023-03-03

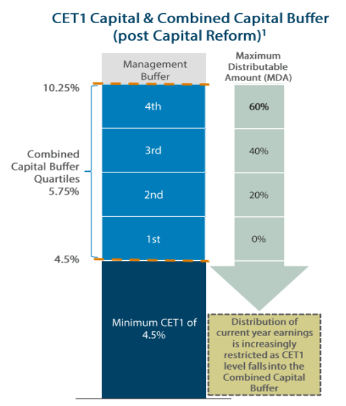

The next diagram shows the common equity tier 1 ratios (CET1) put in place by the Basel III accords. The regulations were effective from January 2023 and are designed to ensure the stability of the global financial system by making the banks hold enough equity and liquidity at any one time. The minimum CET1 ratio stipulated by the accords is 10.25%, with falls below this figure causing dividends to be restricted and staff bonuses to be cut. The AT1/hybrids bonds are implemented as a management buffer above the 10.25% threshold that can be converted into equity if the banks need an emergency capital injection. Thus, in the Credit Suisse scenario, these hybrids should have been converted into equity with holders receiving scrip as per the terms of the takeover offer, but instead, they were written to zero. 4

Source: ANZ Capital Notes 8 investor presentation

The key difference between the Swiss and Australian banking system

Whilst it may be concerning to some over the near collapse of Credit Suisse and the wipe-out of hybrid holders, there are some key differences that differentiate the Australian banking system. Firstly, Credit Suisse is an investment bank, meaning that capital flight (or investor deposit withdrawals) can occur much quicker than the largely retail-based “big four” banks we have in Australia. Investment banks deal largely with wealth management, managing mostly institutional investor accounts and high-net-worth retail clients who can withdraw their money quickly and move it to a different institution (usually another investment bank, of which there are many). This differs from the Australian banking sector, and the big four (CBA, NAB, Westpac and ANZ) which are predominantly consumer banks, with most of their deposits held by retail clients, or individuals. Retail bank deposits tend to be “sticky”, with withdrawals typically occurring at a much slower pace than that of investment banks as individual customers still rely on their banks to facilitate everyday transactions. Thus, the likelihood of a bank run occurring at such a pace that would lead to the collapse of one of the Australian banks is inherently much lower than in other countries whose banking sectors are predominantly comprised of investment banks.

Another key difference is the nature of bank hybrids in Switzerland compared to Australia. Credit Suisse’s hybrid bonds must be written to zero in the event of a government bail-out (which is essentially what happened), whereas in Australia they are converted into equity, diluting shareholders but securing compensation for hybrid holders. This conversion is board approved at the time of hybrid issuance. Likewise, the quality of hybrids is much lower in Europe, with the banks regularly missing distribution payouts on the notes and not converting on-call option dates. This has not occurred yet in Australia. In terms of credit quality, Standard & Poor’s rates Credit Suisse AT1 bonds as “B” or junk, whereas Aussie hybrids are rated as “BBB” – a much superior credit rating. Finally, hybrids here are listed on the ASX, providing a great deal of transparency in how they are traded alongside more salient terms and conditions. By comparison, in Switzerland they are unlisted. This adds an added element of information asymmetry between the issuer and the investor, with their terms and conditions as well as trading volumes ultimately obscured. 5

ASR’s view on the event

We view the possibility of an Australian bank run and a write-off of Aussie hybrids as unlikely. With Australian banks being largely retail-based, the likelihood of a run on any one of the big four banks is much lower than some of the global investment banks. Should a run materialise, the rate of capital flight from our “big four” would be much slower, and thus inherently easier for other banks, or the government to intervene to prevent a collapse. Due to Credit Suisse being an investment bank, it constrained the ability of other banks and the Swiss government to provide the ample liquidity required to stabilise the situation. This was illustrated by the inability of the Swiss central bank’s CHF 50 billion capital injection to prevent CS’s imminent collapse immediately prior to the takeover announcement. 6

Likewise, we see a write-off of Australian bank convertible notes as unlikely due to the board of the big four pre-approving conversion conditions on the issuance date. This provides a greater degree of safety, not present within CS’s or other European bank hybrids. If there was a bank run, we see it as probable that these bonds would be converted into equity, ensuring that holders will still receive compensation for their investment.

Lastly, we view it probable that holders of the written-down AT1 bonds will enter litigation with the Swiss regulator (FINMA), to try and receive compensation as FINMA has essentially undermined the standard bank capital structure. Undermining this structure reduces confidence in the Swiss banking system, which is something that the county takes great pride in. Therefore, it is in the best interest of the government to resolve the situation for hybrid holders in order to restore confidence in the famous Swiss banking system.

Reference List

1&3. UBS acquisition of Credit Suisse Presentation

2. FINMA Website

4. ANZ Capital Notes 8 Investor Presentation

6. https://www.credit-suisse.com/about-us-news/en/articles/media-releases/csg-announcement-202303.html