.png)

Despite Macquarie Group’s (ASX: MQG) reputation as a powerful investment bank in Australia, the company has been creating value by moving away from what they are most known for. With the financial services firm having the reputation of being the “millionaires’ factory” with the culture of doing anything for a bonus, some people in the public may be forgiven for thinking Macquarie is still predominantly a high-flying investment bank. Don’t get me wrong, it is still an important part of the business. However, over the years Macquarie has evolved into a less glamorous business which focuses on building a steady earnings profile that is less exposed to the swings in the economic cycle.

Continuing shift towards growing its annuity-style businesses

With the GFC substantiating how exposed Macquarie was to the economic cycle, management have restructured the company which has resulted in its earnings increasingly being driven by annuity-style characteristics. The shift is still ongoing today, with management prioritising building its asset management division, particularly its infrastructure business. It is also quietly growing its lending business. We believe that this continued shift will see Macquarie’s share price rerate as investors obtain a renewed appreciation of a more stable company that is ultimately less subjected to the whim of the economic cycle.

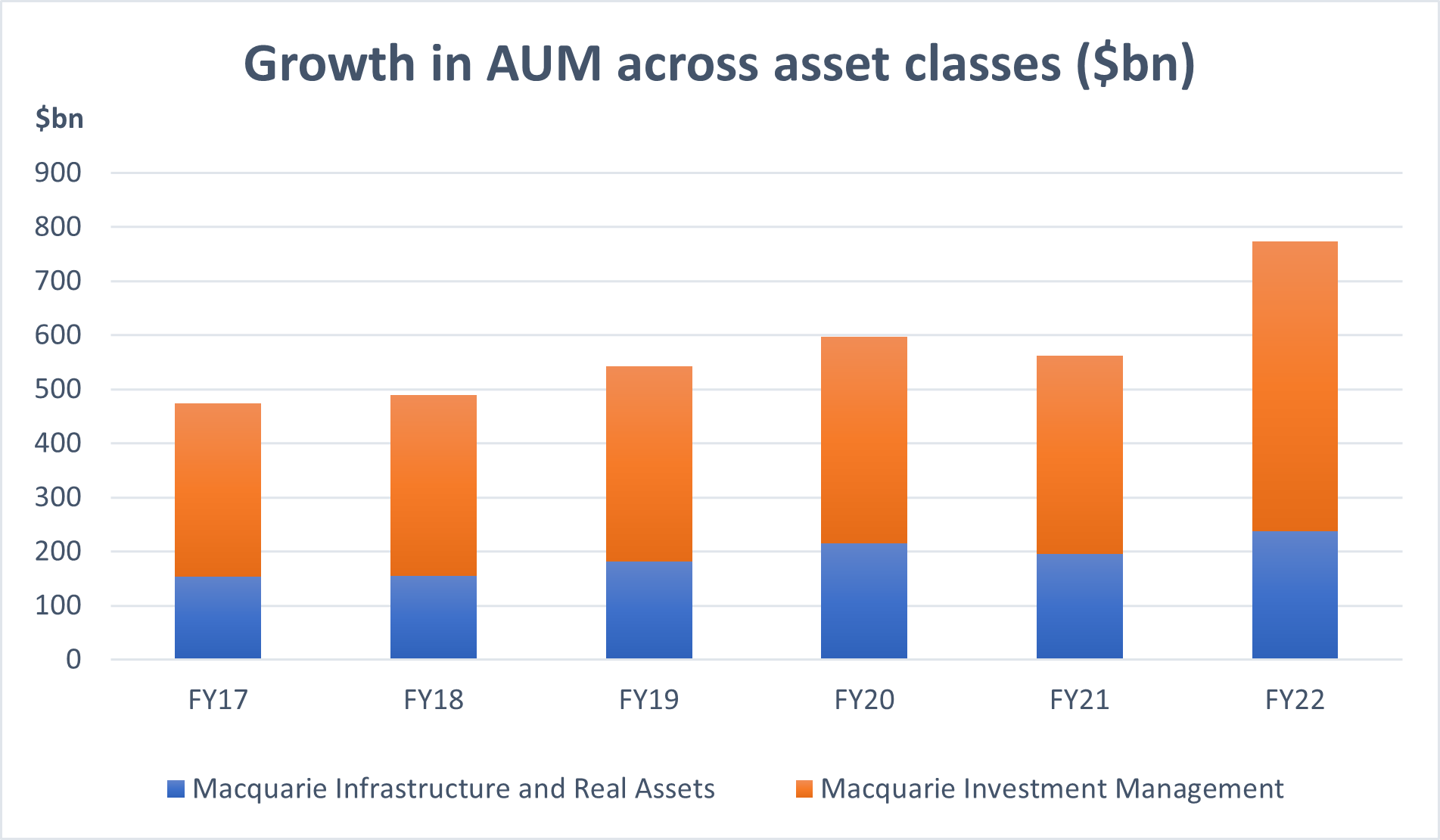

The asset management segment, Macquarie Asst Management (MAM), has a very desirable business model. It is a capital light business which earns a steady recurring stream of management fees on its assets under management (AUM). The business maintains a track record of continually growing its AUM over the long-term, which has grown to over $750 billion. This makes Macquarie the largest asset manager in Australia, and amongst the top 100 in the world. With its AUM growing at a rate of 10.3% per annum over the past five years, we envisage that the business will maintain its track record and its AUM will grow in the high single digits.

Source: Macquarie Group, ASR Wealth Advisors

Source: Macquarie Group, ASR Wealth Advisors

Long lock-up periods in infrastructure funds adds to its stability

We particularly see the value in its infrastructure and real assets business, which sits within MAM and is aptly named Macquarie Infrastructure and Real Assets (MIRA). As the world’s largest infrastructure manager, we believe its scale as well as its reputation for having specialist capabilities gives it a competitive advantage which assists with attracting inflows. The attractiveness of MIRA’s business model lies in its exceptionally stable earnings profile. Due to the long-term nature of infrastructure investments, MIRA's unlisted funds have longer than average lockup periods of around 7-10 years. This is particularly beneficial during periods of economic uncertainty and market volatility where other asset managers may see higher levels of AUM outflows.

Furthermore, the stable earnings profile of the underlying infrastructure assets makes this asset class more desirable during times of uncertainty and volatility. We also like the fact that infrastructure such as utilities and toll roads have inflation pass-through characteristics due to regulated price increases that either partially or fully matches inflation.

Well-placed to benefit from huge global infrastructure investment needs

Not only do we like MIRA's stability, but we believe global infrastructure demand will result in MIRA being a key driver of long-term growth for Macquarie. A report conducted by Oxford Economics forecasts that global infrastructure investment needs to reach US$94 trillion by 2040 to keep up with economic and demographic changes. Based on trends at the time of this report, there is forecasted to be an investment shortfall of US$18 trillion.

Around half of this shortfall is for road and electricity infrastructure, with many countries having infrastructure which is significantly outdated and insufficient to keep up with the demands of the economy and population growth.

As the world’s largest infrastructure manager, MIRA is well-placed to have a very significant role in driving this investment. To put into perspective how significant MIRA’s infrastructure assets are, over 100 million people globally utilise these assets each day. Each year, 115 million people use MIRA’s telecommunications infrastructure, 12 million passengers fly through their airports and 6 million shipping containers are handled at their ports, amongst other things.

A multi-decade opportunity in renewable energy

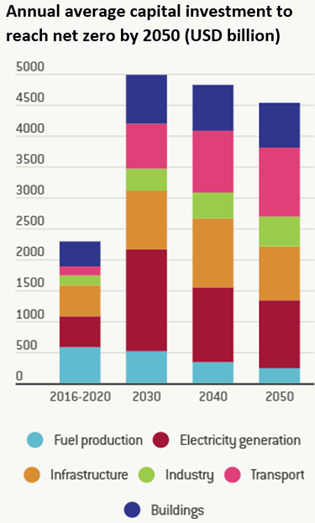

It is undeniable that the world is undergoing a transition towards renewable energy and decarbonisation. This is perhaps one of the biggest megatrends that we will see occur in our lifetime, as most of the world attempts to reach net zero by 2050. MIRA is a significant force in this domain, with its specialist division Green Investment Group (GIG) having over $38 billion in investments committed to developing companies, assets and technologies to accelerate this transition. This includes over 30 gigawatts of capacity in development across more than 240 projects.

According to the International Energy Agency, current investment in renewable energy is approximately US$2 trillion per year. The agency forecasts that this will need to increase to between US$4.5-5 trillion annually for the next three decades for the world to reach its net zero carbon emissions commitment. With GIG at the forefront of decarbonisation investments in the private sector, it is well-positioned to see long-term growth.

Source: International Energy Australia

Macquarie is quietly growing its mortgage book

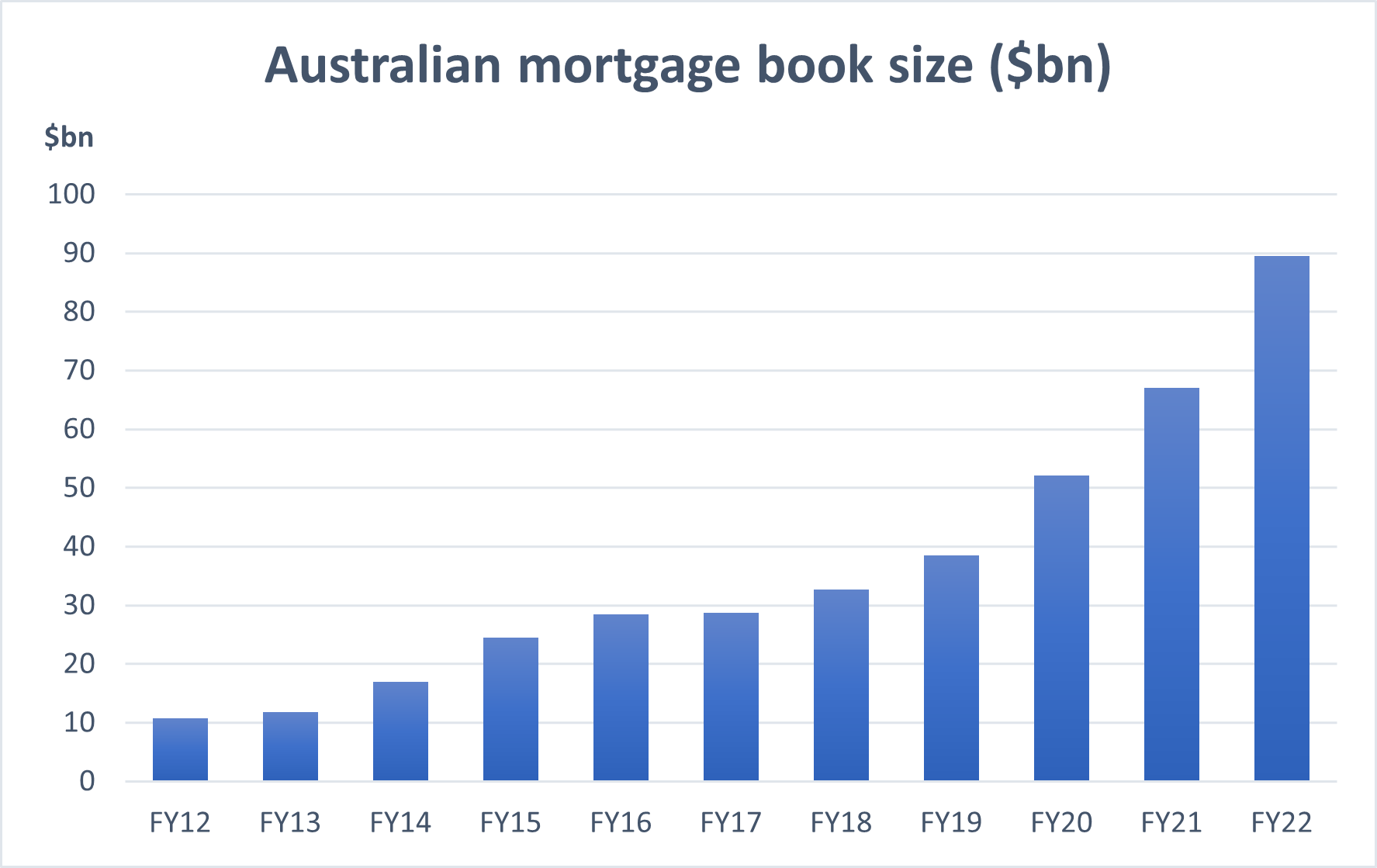

Despite the company’s other segments garnering much more attention, its Banking and Financial Services (BFS) business is very underrated. What has gone under the radar is that in this segment, Macquarie has been materially expanding its market share in Australia’s highly competitive mortgage market. This is impressive given that the home loan market is dominated by the big four banks. Despite their dominance, in the last 2 years alone Macquarie has increased its mortgage market share from 2.7% to 4.4%. The company is putting up some pretty big growth numbers in the mortgage space, with its home loan portfolio increasing by 33.6% in FY22. In fact, Macquarie’s mortgage book has grown at 23.5% per annum over the last 10 years.

Source: Macquarie Group, ASR Wealth Advisors

Source: Macquarie Group, ASR Wealth Advisors

That’s not to mention the impressive numbers in the other areas of BFS. In FY22, Macquarie grew its business banking loan portfolio by 13% to $11.5 billion, funds on its wealth management platform Macquarie Wrap increased by 17% to $118.6 billion, and its total deposits was up by 21% to $98 billion. Although it may be less exciting than Macquarie’s other segments, we like the growth we are seeing in BFS, particularly as it is also a relatively stable annuity-style business. It is also not an insignificant part of the business, contributing to around 10-15% of Macquarie’s net profit in a typical year.

The commodities and trading business should continue to benefit from energy volatility

Macquarie’s Commodities and Global Markets (CGM) division has experienced significant tailwinds as a result of the global energy volatility. This volatility has been driven by numerous global factors affecting supply and demand. These includes sanctions on Russia and retaliatory measures related to the war in Ukraine, OPEC+ supply of oil, and the uncertainty of economic activity in China due to lockdowns but with stimulus on the way, amongst other factors. With the war in Ukraine unlikely to reach a quick resolution, we believe there is a significant chance that this volatility will persist. This remains especially true as we come into the European winter, in which Russia will be able to further leverage its role as a key supplier of energy to Europe.

Macquarie has a team of specialised professionals in this division, which helps maintain its place as a major player in commodities and trading. Macquarie is one of the top businesses in natural gas and LNG, oil, derivatives, base metals and commodity research, as well as being one of the major physical gas marketers in North America and is the leading ASX futures broker.

Macquarie still sees the ups and downs of the economic cycle, but to a lesser extent

Whilst there is an increasing focus on its annuity-style businesses, Macquarie still maintains a material exposure to its market-facing businesses. Its market-facing businesses includes CGM (excluding Specialised and Asset Finance) and Macquarie Capital, its renowned investment banking arm. Whilst its market-facing businesses usually contribute to around 40% of annual net income, in a buoyant market this portion increase to over half of net income. This happened during FY22, where Macquarie Capital’s contribution to net profit increased from 11% to 25% amidst a boom in mergers and acquisitions (M&A), IPO listings and debt capital markets activity.

Whilst earnings in FY22 were boosted by strong markets activity, a tougher environment so far in FY23 has resulted in a significant pullback in transaction activity. This will likely result in the Group’s net profit to decrease in FY23, highlighting the impact that the ups and downs of its market-facing businesses have. We note that the yearly variance in earnings is much less pronounced due to the company’s shift towards building its annuity-style businesses. A further shift will further flatten the volatility in earnings, which is something we look forward to.

How does Macquarie’s valuation look?

With a forward P/E of 15.3x, Macquarie’s valuation is trading at the lower end of its 3-year range, excluding March and April 2020, when markets collapsed due to the onset of Covid-19. The company is also trading around the middle of its 5-year range. In the past 5 years, positive developments relating to Macquarie includes the renewable energy transition theme taking hold, a premium assigned to stable infrastructure assets as demonstrated multiple ASX-listed infrastructure companies being acquired, as well as strong growth in Macquarie’s asset management and lending businesses. Due to these factors, we believe that the company has added significant value in the past 5 years, despite trading at a P/E multiple in the middle of its 5-year range. Based on this, we believe Macquarie’s current share price represents good value, particularly with the share price falling from highs above $210 earlier this year.