Sleep-apnea device maker ResMed inc. (ASX: RMD) handed down its December quarterly and half-yearly earnings results on the 27th of January. With RMD being dual-listed on the ASX and the New York Stock Exchange (NYSE), investors across both markets appraised the result.

Both earnings per share (EPS) and revenue for the December quarter exceeded US broker consensus expectations which was good to see, with the ASX listed shares rising 2.2% on the day of the announcement. Some highlights of the quarterly include the following:

-

-

-

-

Revenue increased by 16% to 1.034 billion.

-

Gross margins contracted by 30 bps to 56.1%.

-

Net income increased by 11% to $224.9 million.

-

-

-

Revenue and profits up, but margins contracted

Overall, during the quarter, there was a significant increase (41%) in machine sales across Canada, the US, and Latin America compared to the prior corresponding period (December 2021). Additionally, Software as a service (SAAS) revenue was up 18%. Together these standout results helped fuel revenue and income growth, with RMD continuing to benefit from the sugar hit associated with pent-up demand for its devices.

The contraction in gross margins was the most concerning aspect of the earnings announcement, with normalised gross margins decreasing by 30 basis points and by 80 basis points on a non-normalised basis. This occurred predominantly due to both an unfavourable product mix as well as foreign currency movements and was partially offset by an increase in average selling prices for the devices. RMD’s margins have also come under pressure due to elevated freight costs, with the company forced to use costly air freight instead of lower-cost sea freight due to lower production levels.

A strong half-yearly result that broadly met market expectations

Some highlights of the half-yearly result (H1 23) include the following:

-

-

-

-

Revenue increased by 10% to 1.984 billion.

-

Gross margins increased by 1% to 56.5%.

-

Net income increased by 6% to $466.5 million.

-

-

-

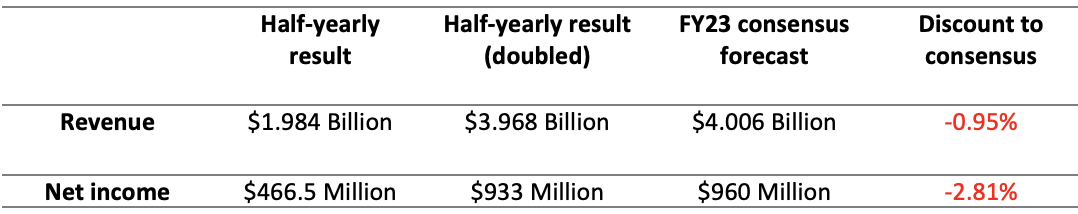

Doubling the half-yearly earnings result and comparing it to the consensus forecasts for the full-year result (FY23) can indicate whether RMD’s earnings are on track to meet expectations. Broadly speaking, both revenue and net income across the half fell short of consensus, with net income missing the mark more so than revenue.

Source: RedMed, IRESS, ASR Wealth

Source: RedMed, IRESS, ASR Wealth

At face value, this may appear like a miss. However, it’s important to emphasise that ResMed may experience a stronger second half than its first, meaning the business would ultimately be on track to meeting or exceeding consensus earnings estimates. This view was supported by several brokers who raised their target prices on the stock after the announcement, indicating that earnings broadly met expectations.

Our take on the result and the business

Due to the underlying tailwinds RMD is experiencing, we have faith that the full-year result will align with or exceed consensus forecasts for the full year. Judging by the December quarterly results, we believe the following four catalysts are beginning to play out and will be reflected more so in the full-year result (FY23).

-

-

Pent-up demand for elective medical treatments/procedures – Covid-19 restrictions meant that many non-critical healthcare procedures and services were shut down, with sleep clinics being a notable example. This ultimately meant fewer diagnoses of sleep apnea and less demand for the devices and associated consumables that RMD sells. With Covid-19 restrictions now removed across most major economies, we expect to see an increase in the incidence of diagnoses of sleep apnea. This should lead to more demand for ResMed’s machines and masks.

-

Recalls from their major competitor – The sleep apnea industry is an oligopoly, with ResMed, Fisher & Paykel Healthcare, Philips, and CareFusion accounting for 90% of the market. Philips has been out of the market for 18 months after announcing a device recall. This has invariably directed more consumers to RMD’s products. We believe this will continue to place RMD in a superior competitive position, with Phillips experiencing a significant dent in their credibility and reputation because of the recall.

-

Non-discretionary demand for healthcare – An improved competitive position and the non-discretionary demand profile for healthcare should provide RMD with pricing power. This was noted in the December quarterly, with the business successfully raising prices. This failed to materially improve margins because of rising costs. Nevertheless, we have faith that the non-discretionary demand profile of their consumers will allow them to offset any further margin pressures with price rises down the line.

-

Easing supply-chain constraints – With supply-chain constraints beginning to unwind, RMD can produce a significantly greater volume of devices to keep up with demand. The company’s device production volume is exceeding 2019 levels thanks to a larger manufacturing facility in Singapore and easing chip shortages. As production increases, RMD can take advantage of lower-cost sea-borne freight, which will ease recent margin pressures.

-