Trading of Nickel industries (ASX: NIC) was halted on the 18th of January after the nickel pig iron producer delivered its December quarterly report and announced a $671 million equity raise.

A positive quarterly activities report

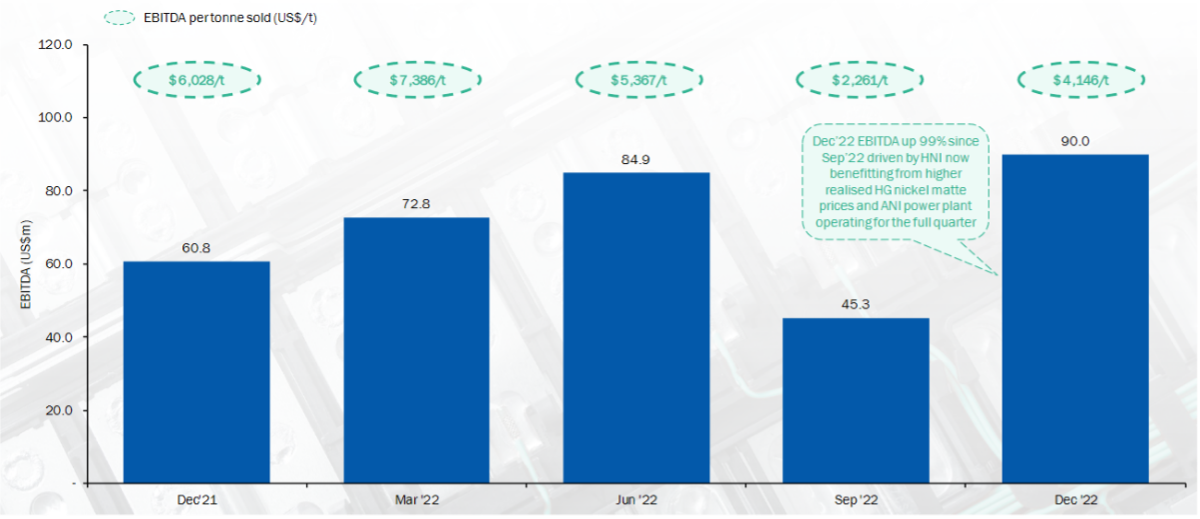

The December quarterly activities report provided welcome news for shareholders. Nickel metal production levels increased 13.8% from the September quarter to 23,072 tonnes, with group EBITDA margins improving significantly from US$2,261/tonne in the September quarter to US$4,146/tonne in the December quarter. This 99% increase was driven by improved contract pricing and lower cash operating costs. Lower operating costs were driven by the Angel Nickel Project’s (ANI) power plant running at full capacity, which decreased the operation’s power costs significantly relative to the September quarter.

Source: NIC investor presentation (18/01/23)

Source: NIC investor presentation (18/01/23)

Particularly pleasing was the contribution of the Hengjaya Nickel Project (HNI), with margins improving from ~US$2,000/tonne in the September quarter to US$5,950/tonne in the December quarter because of its complete transition to the production of nickel matte, which is a higher margin, class 1 battery-grade nickel product.

Other positive announcements encompassed within the quarterly include the continued ramp-up of the Angel Nickel Project (ANI) to over 130% of nameplate capacity and the on-track commissioning of the Oracle Nickel Project (ONI).

Nickel sulphate (Class 1) versus nickel pig iron (Class 2)

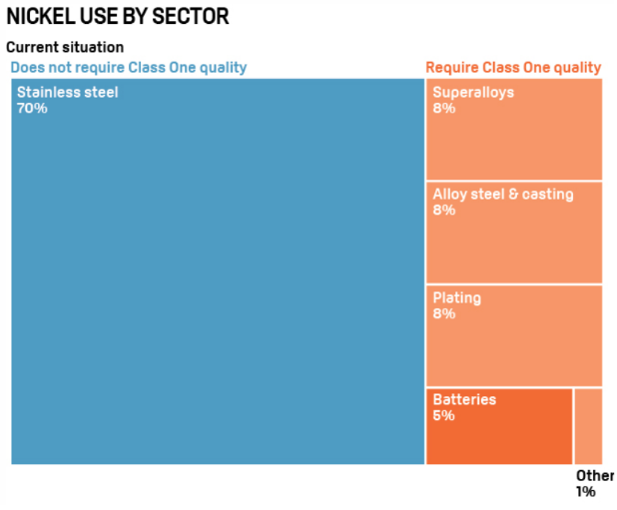

Nickel Industries is most known for its production of nickel pig iron (NPI), which is a lower-grade (Class 2) nickel product that is derived from a mixture of the lower-grade nickel ore bodies mined in Indonesia (laterite), coking coal as well as gravel and sand. This mixture is then heated in a blast furnace to create the final NPI product. From here, NPI is used as a key input in the stainless-steel manufacturing process.

Source: StoneX, Nickel Institute, S&P Global Patt’s Estimates

Source: StoneX, Nickel Institute, S&P Global Patt’s Estimates

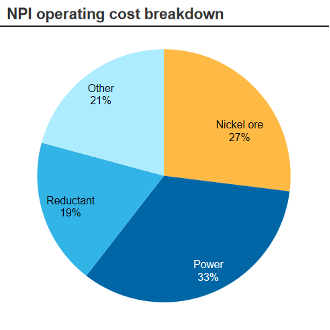

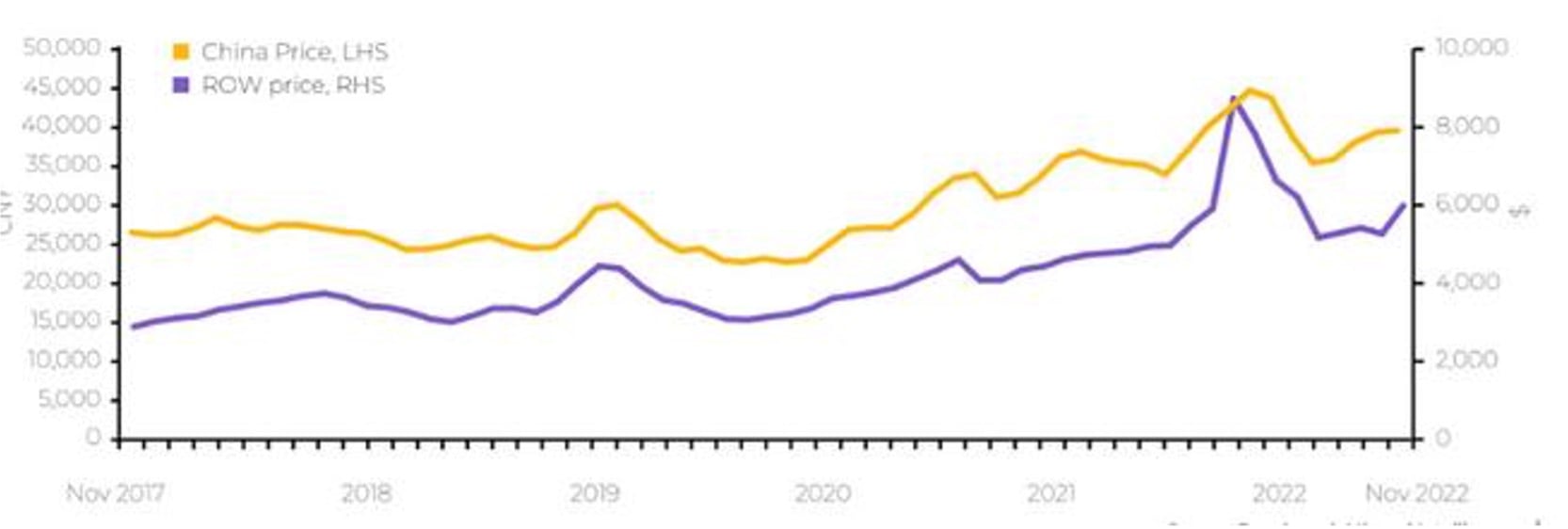

NPI prices have weakened throughout the latter half of 2022 due to weak Chinese economic growth and manufacturing, which has consequently led to falling demand for stainless steel. Compounding this margin weakness for NIC has been rising thermal coal prices, which have increased the cost of processing nickel ore bodies into nickel pig iron.

Source: NIC, Macquarie Research, January 2023

Source: NIC, Macquarie Research, January 2023

Whilst NPI prices have come under pressure during 2022, both demand and prices for battery-grade (Class 1) nickel sulphate continue to strengthen. Nickel sulphate is a key input in the production of cathodes for lithium-ion batteries and is derived from the mining of nickel sulphide ore deposits. As has been the case with many other battery-grade metals of late, class 1 nickel products have been in hot demand to keep up with record levels of battery manufacturing. This has stemmed from increased EV uptake/demand as well as demand for grid-based energy storage applications.

Nickel Sulphate Prices - Source: Benchmark Mineral Intelligence

Nickel Sulphate Prices - Source: Benchmark Mineral Intelligence

A strategic shift to battery-grade nickel production

Most recently, NIC has successfully transitioned its production of NPI at Hengjaya over to nickel matte, where nickel matte is an intermediate nickel product that can be further processed into battery-grade nickel sulphate. By producing nickel matte, NIC can gain exposure to the higher prices of battery-grade nickel using the lower-grade nickel ore bodies that are readily available in Indonesia.

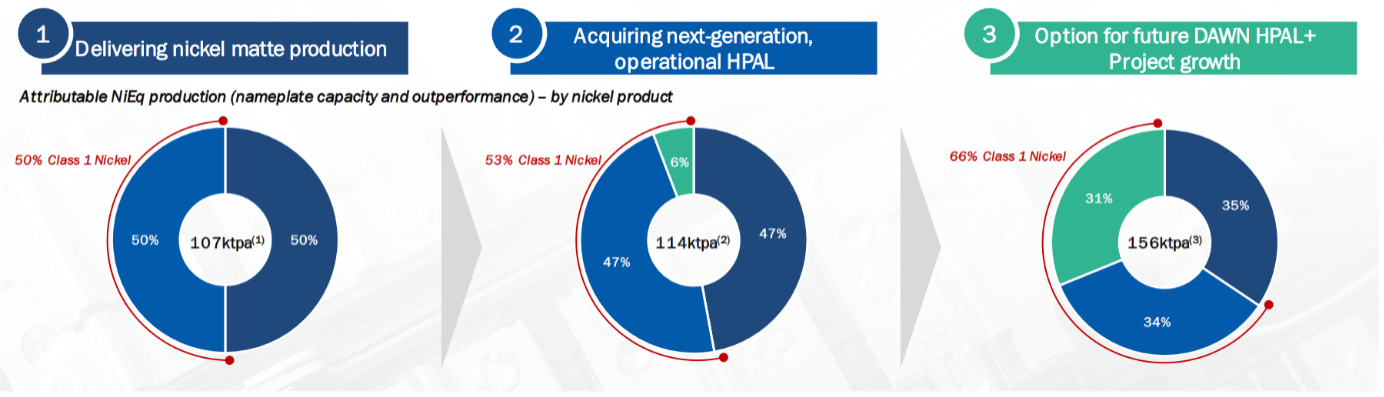

Through the announcement of its equity raise, NIC has laid out its strategy to transition from its historical focus on NPI and the stainless-steel market to become a significant producer of battery-grade nickel. The three key pillars of its strategy include:

1. Increasing nickel matte production

2. Increasing high-pressure acid leech (HPAL) production

3. Collaborating with Shanghai Decent to develop additional HPAL production through the DAWN HPAL + project

Source: NIC company presentation (18/01/23)

Source: NIC company presentation (18/01/23)

The proceeds of the equity raise will be used to acquire a 10% interest in the PT Huayue Nickel Cobalt HPAL project. In addition, NIC will also employ a portion of the capital raised to expand its NPI production capacity by exercising its option to acquire an additional 10% in the Oracle nickel project. This will take its total interest to 80% (up from 70% previously). Finally, the company will also acquire options to participate in the DAWN HPAL+ project and the conversion of Oracle’s operations to nickel matte.

According to this roadmap, over 66% of NIC’s production profile could be comprised of Class 1 Nickel in the coming years. This would mean that the company’s earnings are ultimately more leveraged to battery-grade nickel prices than NPI prices.

Questions remain over the economics and environmental impact of the HPAL process.

High-pressure acid leach (HPAL) is a process used to extract nickel from laterite ore bodies. Whilst HPAL has some advantages, including the ability to convert the low-grade nickel laterite ore contained in Indonesian deposits to the higher-grade variety, there are several challenges involved with using this process.

Namely, HPAL operations are capital-intensive to set up and require high levels of sustaining CAPEX once operational. Additionally, HPAL is very energy-intensive, which can squeeze producer margins as the cost of energy increases. Most of the existing HPAL facilities are coal-fed, with the process ultimately emitting up to three times more greenhouse gases than nickel production from high-grade sulphide deposits. The use of nickel derived from HPAL could therefore pose a significant problem for battery and car makers facing increasing pressure from investors to minimise their scope 1, 2, and 3 emissions.

The mining of nickel sulphide ore (as opposed to laterite) is ultimately a much lower-cost pathway to producing battery-grade nickel sulphate. Despite this, it is widely expected that global sulphide ore mining will struggle to meet the soaring demands of the battery sector. As such, there is a significant opportunity for the nickel matte and HPAL production processes to fill the battery-grade nickel supply shortfall that is widely expected to persist into the medium to long-term.

How did the market react?

When NIC resumed trading on the 19th of January, the share price fell by 6.7%, which reflected the dilution to existing shareholders caused by the equity raise. Based on this share price movement and the gains seen in subsequent trading days, it appears that the December quarterly trading update was well received by the market.

Our take on the announcement

Whilst we acknowledge that an equity raise isn’t always the best news for existing shareholders, we believe the institutional placement will be transformative with respect to NIC’s future earnings profile.

We believe there is a significant opportunity for lower-grade nickel ore producers such as NIC to meet the projected shortfall in the production of nickel sulphate. This would give NIC a welcome earnings boost, given the premium that battery-grade nickel products sell for compared to class 2 nickel.

Whilst the transition of existing NPI operations to the production of nickel matte is a relatively easy and cheap process, the development of HPAL is both time and capital-intensive. It is also a process that is environmentally damaging. Whilst these represent significant challenges, should NIC and its partners successfully harness HPAL as a means of transforming their production profile, there is significant opportunity to grow their future earnings.

It’s important to emphasise that NIC’s current production profile is still predominantly dominated by NPI, with its production of nickel matte a relatively recent occurrence. The transition to further production of battery-grade nickel will take time and may require additional capital down the track, meaning a potential debt or equity raise. Nevertheless, we remain attracted to NIC’s position as a low-cost producer of both Class 1 and 2 nickel and believe its current valuation (forward P/E of 7.5, EV/EBITDA of 2.99) and forward yield (5.58%) are inherently attractive considering the business’s prospects.