IGO has struck an agreement worth AUD$136 million to acquire a 100% stake in Essential Metals’ (ASX: ESS) alongside the Chinese Tianqi Lithium Corporation via their joint business venture, Tianqi Lithium Energy Australia (TLEA). TLEA comprises of a 51% stake owned by the Tianqi Lithium Corporation and a 49% stake held by IGO. The agreement implies a takeover price of 50 cents per share, representing a 36.3% premium on the average traded price from the last 40 days. This follows a unanimous recommendation from the ESS board to its shareholders to accept the takeover bid.

What does this takeover mean for IGO?

The takeover agreement will see TLEA take control of the Pioneer Dome Lithium Project in Western Australia, spanning an area of 450km² between the towns of Kalgoorlie and Esperance. Presently, the Lithium project is under early-stage drilling, with it being several years away from becoming operational. The distance between Pioneer Dome and Greenbushes is large (roughly 600km), which suggests IGO has the desire to push into a new province rather than expand its existing production in and around its Greenbushes asset.

IGO is currently a producer of Cobalt, Copper, Nickel, and Lithium, with the acquisition indicative of the company’s increased strategic emphasis placed on Lithium assets into the future. The project will require significant capital expenditure by IGO and Tianqi without immediate production guarantees. Still, it offers IGO the ability to extend its Australian Lithium operations, with IGO’s premier lithium asset, Greenbushes having a finite mine life of 20 years. This is a significant long-term challenge for IGO, so securing an early-stage Lithium project provides coverage for any falling lithium output in the future.

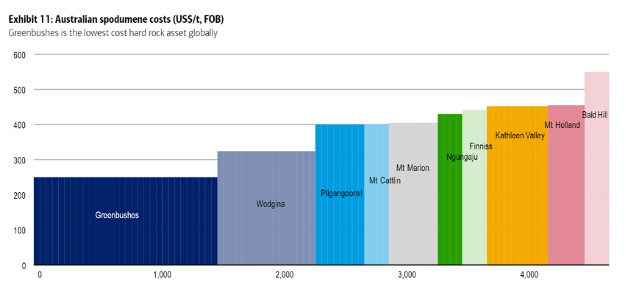

Source: BofA Global Research - January 2022

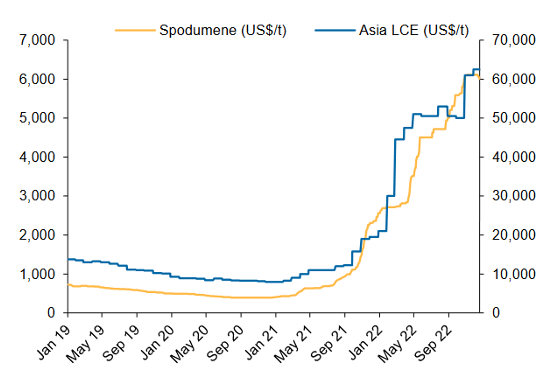

Source: BofA Global Research - January 2022

The pioneer dome project is proximal (< 70km) to the Mt Marion lithium mine, which is owned and operated by major Lithium and Iron Ore producer Mineral Resources (ASX: MIN). Whilst many factors can influence the cost of production between now and when the first shipments begin, Mt Marion’s positioning in the chart above can give us some indication of where the prospective mine may lie on the lithium production cost curve.

Lithium prices – where to from here?

Throughout 2022, lithium prices have been on quite the tear, rising from $US 2000 per ton of Spodumene to $US 6000. This has delivered a significant windfall for Australia’s major lithium miners currently in production (e.g., PLS, MIN, AKE, and IGO). Lithium’s current prices are a function of a demand imbalance in the market, where demand for Lithium far exceeds supply.

Drivers of this meteoric rise in demand include a substantial increase in electric vehicle (EV) demand/production and demand for lithium-ion batteries for use in grid-storage applications and consumer electronics. This trend is only likely to accelerate as most global economies re-gear to transition to the achievement of net-zero emissions by 2050 successfully.

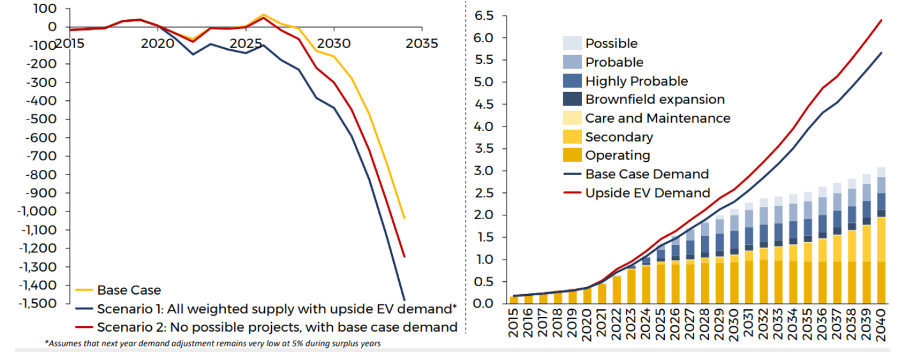

Source: Company Data, Macquarie Research, December 2022

In the wake of this significant rise, there has been investor trepidation with respect to where prices go from here. Whilst there is a consensus that lithium prices will remain buoyant over the long term due to the prospect of a structural supply deficit, there are fears that new supply coming on board will lead to falls in the lithium price. Encouraging this new supply is the lure of “supernormal” profits currently being achieved in the sector. Lithium forecasting company Benchmark Mineral Intelligence illustrates this point through the charts below. The lithium market is expected to be in a surplus during 2026 before re-entering a significant structural deficit. With most new lithium production taking 5+ years to become operational, supply constraints are likely to remain a feature of the lithium market from 2030 onwards.

Source: Benchmark Mineral Intelligence Q3 2022 Forecast

Our thoughts on the acquisition

We view the takeover as a key, long-term strategic move for IGO. Whilst the current frenzy in the lithium market means IGO has likely paid a premium for the assets, the joint acquisition delivers tangible benefits for the business.

The first benefit is that the Lithium contained in the Pioneer Dome deposits is Spodumene, as opposed to Brine. Spodumene differs from Brine in that it is often cheaper to produce, less susceptible to changes in the weather, and, once extracted, can easily be processed into Lithium Hydroxide, the key input in lithium-ion batteries. Brine-based Lithium has to be processed twice, once into Lithium salt and again into Lithium Hydroxide, adding additional cost to the end customer. This gives IGO, and many other Australian-based spodumene producers, a competitive advantage over their Brine-based lithium producer counterparts.

IGO’s desire for additional Australian-based operations is also a competitive advantage in terms of the heightened geopolitical uncertainty and supply chain risk tied to lithium operations in China. There has been an increased desire by companies in the batteries supply chain to diversify their reliance away from China over fears that the government may impose restrictions that negatively impact their operations. This has also been recognised at a government level, with the US making significant investments in a host of critical minerals-related businesses to reduce their battery minerals supply-chain risk. Thus, demand for IGO’s output at the Pioneer Dome project is unlikely to be lacking.

Finally, as duly noted, IGO’s Greenbushes has a finite life span of 20 years. This exacerbates the need for the business to sure up its long-term production profile to capitalise on the high lithium prices forecast from 2030 onwards. The Pioneer Dome project goes a long way to fulfilling this need as IGO continues on its strategic journey to become an all-in-one battery metals player.