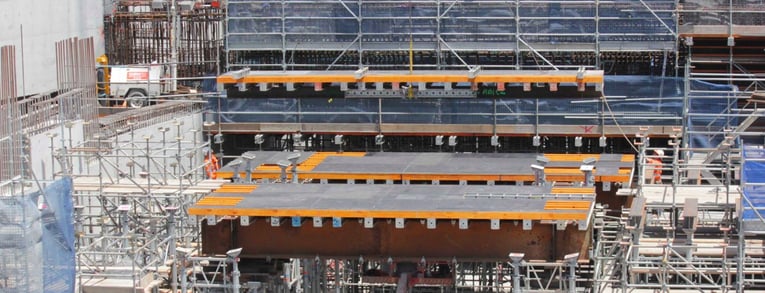

Acrow Formwork and Construction Services Limited (ASX: ACF) is an Australian microcap (market capitalisation is around $60M) focusing on formwork and scaffolding solutions for civil infrastructure projects. Infrastructure projects are typically carried out during recessionary periods to stimulate the economy. This makes Acrow’s revenue relatively defensive.

Over FY2019, Acrow grew both revenue and EBITDA by +9% to $71M and $11.6M respectively. Acrow trades on a PE ratio <7X and pays a dividend >6%, providing a great income to investors. The firm also generates a high Return on Equity (ROE) of 17.3%.

On 17 October, Acrow announced the acquisition of QLD based Uni-span for $21.25M at a low valuation of 4.4X 2019 EBITDA. The acquisition will be funded through the firm’s debt facility with Westpac. Traditionally, debt-funded acquisitions are better for shareholders than those that are financed through equity. After the acquisition, Acrow will maintain a low level of gearing (with net debt/EBITDA increasing from 0.3X pre-acquisition to 1.1X post-acquisition).

Pleasingly, the acquisition will result in earnings per share (EPS) accretion of 22% before the realisation of any other benefits. Uni-span brings revenue synergies and integration benefits to the overall business. These include complementary products and services, as well as yard consolidation (where formwork and scaffolding equipment are stored), staffing and overhead reductions.

The combined business was recently awarded a $2.75M contract to provide formwork propping solutions for Sun Metals Zinc Refinery expansion. This early win for the combined company bodes well for the future as an indication that the combined range of products will increase the likelihood that Acrow wins projects.

An exciting part of Uni-span business is its development of ‘Uni-mesh’, a fire-retardant mesh product benefiting from increased safety requirements nationwide. The selling of Uni-mesh represents a further revenue stream for the combined business and is attractive as a specialist product. If the Uni-mesh product does a job that no other product can do as effectively, it has a strong economic moat and revenue is sticky.

Acrow could deliver defensive returns to investors (provided the firm maintains its focus on civil infrastructure and its low leverage). This is particularly important today as some investors fear that Australia is facing significant recessionary risk with uncertainty regarding economic growth, consumer spending and international trade war risk.

Disclaimer:

This article has been prepared by the Australian Stock Report Pty Ltd (AFSL: 301 682. ABN: 94 106 863 978)

(“ASR”). ASR is part of Amalgamated Australian Investment Group Limited (AAIG) (ABN: 81 140 208 288 Level 13, 130 Pitt Street, Sydney NSW 2000).

This article is provided for informational purpose only and does not purport to contain all matters relevant to any particular investment or financial instrument. Any market commentary in this communication is not intended to constitute “research” as defined by applicable regulations. Whilst information published on or accessed via this website is believed to be reliable, as far as permitted by law, we make no representations as to its ongoing availability, accuracy or completeness. Any quotes or prices used herein are current at the time of preparation. This document and its contents are proprietary information and products of our firm and may not be reproduced or otherwise disseminated in whole or in part without our written consent unless required to by judicial or administrative proceeding. The ultimate decision to proceed with any transaction rests solely with you. We are not acting as your advisor in relation to any information contained herein. Any projections are estimates only and may not be realised in the future.

ASR has no position in any of the stocks mentioned.