Brambles (ASX: BXB) announced quarterly sales growth of 5% when adjusted for the effects of FX movements. The business was strongest in the Americas, where sales revenue grew by 7%. If the company keeps these growth rates up, revenue will be higher than expected for FY19, which drove a small re-rate in the share price.

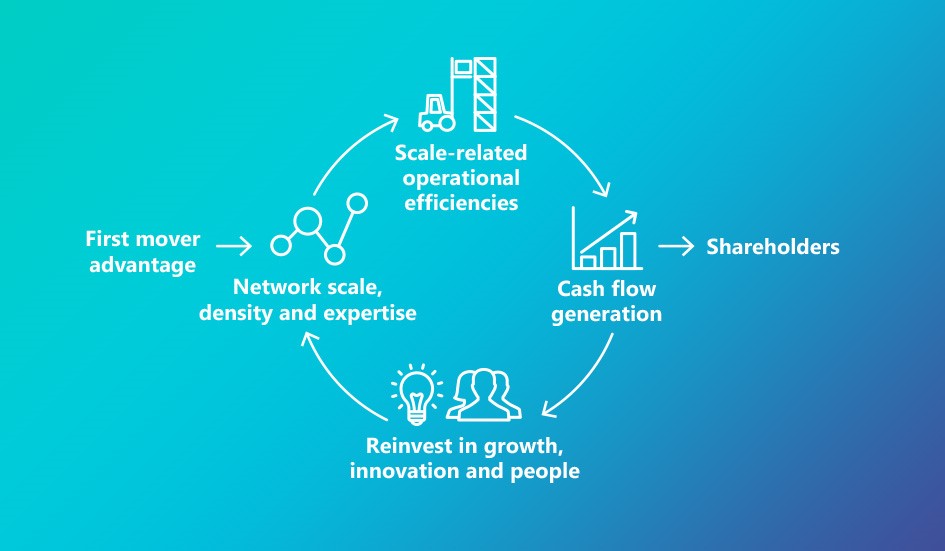

Brambles’ strategic priorities going forward (Credit: Brambles)

Expectations for Brambles have been set quite conservatively in recent times, after disappointing full-year numbers. Sales revenue grew by 7% while underlying profit only rose 2%, as cost inflation and changing consumer behaviour provided challenging market conditions for their core business. Their outlook for FY20 was for sales revenue growth to sit in the mid-single digits, with the global economy and a weaker automotive industry contributing to the gloomy outlook. The main upside from the results is that the slowdown was linked to the market and economic factors, not a structural deterioration in Brambles’ underlying business. The fact that they have already achieved this mid-single-digit sales growth means any further growth this year represents upside to forecasts.

The company focusses on developing solutions by which clients can outsource the management of pallets crates and containers. Brambles will then make its money by providing end to end supply chain solutions to clients, utilising its global scale and market knowledge to deliver the best solutions for clients. They also transport goods and have a long list of blue-chip clients who use their products. Key industries the company serves include consumer goods, fresh produce, beverage, retail and general manufacturing. Brambles aim to compete primarily on its scale, density and expertise, all of which are developed over a long period of time and present competitive advantages that are hard for other firms to overcome.

Going forward, Brambles aims to grow and strengthen these competitive advantages, while also making their own organisation more efficient. They aim to become more innovative, which could help them protect their margins. In broad terms, the company is satisfied with its existing competitive advantages but wants to develop them further to strengthen its competitive moat.

Disclaimer:

This article has been prepared by the Australian Stock Report Pty Ltd (AFSL: 301 682. ABN: 94 106 863 978)

(“ASR”). ASR is part of Amalgamated Australian Investment Group Limited (AAIG) (ABN: 81 140 208 288 Level 13, 130 Pitt Street, Sydney NSW 2000).

This article is provided for informational purpose only and does not purport to contain all matters relevant to any particular investment or financial instrument. Any market commentary in this communication is not intended to constitute “research” as defined by applicable regulations. Whilst information published on or accessed via this website is believed to be reliable, as far as permitted by law we make no representations as to its ongoing availability, accuracy or completeness. Any quotes or prices used herein are current at the time of preparation. This document and its contents are proprietary information and products of our firm and may not be reproduced or otherwise disseminated in whole or in part without our written consent unless required to by judicial or administrative proceeding. The ultimate decision to proceed with any transaction rests solely with you. We are not acting as your advisor in relation to any information contained herein. Any projections are estimates only and may not be realised in the future.

ASR has no position in any of the stocks mentioned.