Cochlear (ASX: COH) is up 22.3% this year, on the back of successful product development execution and a strong earnings beat. The company’s shares rallied 3.1% after they posted their full year results, with the market particularly excited about their future growth potential. Revenue from their signature Nucleus 7 Sound Processor increased by 17% over the prior period, while their services segment is equal to 30% of sales revenue. Their services business creates a recurring, annuity style revenue stream which is perceived by most investors to be of a higher overall quality than the rest of their revenue. Another notable development out of their recent annual results is a sizeable uptick in their gross margin, which rose by 3 percentage points to 76%.

Cochlear has executed well for decades (Credit: Health Direct)

Profits have grown around 6-fold in the past 15 years, with similar growth in the share price. While the company never shoots the lights out with its annual results the way tech giants do, the ability it has to deliver consistent year on year profit growth over long periods of time has created tremendous value for a large number of investors. There is also the prospect of multiple expansion on the back of rising earnings quality across the business, which makes Cochlear an attractive company. Nevertheless, at over 40x earnings, a lot of this information is already in the price.

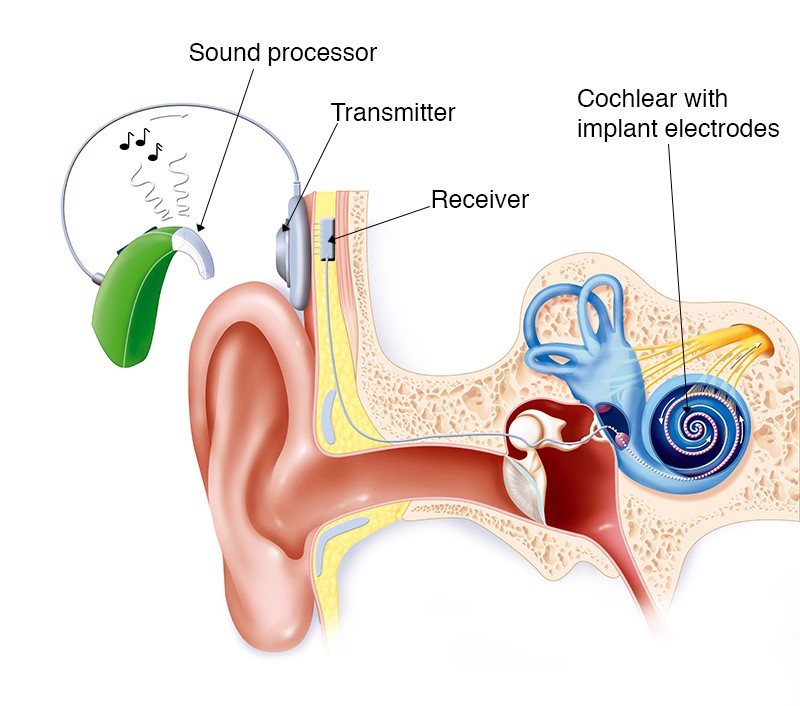

Cochlear produces hearing aids which are particularly popular among older people with partial hearing loss. While most hearing aids magnify sound, eventually damaging the person’s hearing further, Cochlear implants bypass the damaged part of the ear and stimulate the nerve which picks up sound. This represents a significant advantage over competitors and has allowed the company to steadily grow their market share over time. An additional benefit is being able to treat completely deaf people, a market in which Cochlear is the clear industry leader.

Their new Nucleus 7 Sound Processor can be controlled form a smartphone, which allows for optimisation features not available on a standard hearing aid. It can also serve people who could not be helped by existing products, expanding the addressable market of hearing impaired or deaf people that could be served well by the product.

Disclaimer:

This article has been prepared by the Australian Stock Report Pty Ltd (AFSL: 301 682. ABN: 94 106 863 978)

(“ASR”). ASR is part of Amalgamated Australian Investment Group Limited (AAIG) (ABN: 81 140 208 288 Level 13, 130 Pitt Street, Sydney NSW 2000).

This article is provided for informational purpose only and does not purport to contain all matters relevant to any particular investment or financial instrument. Any market commentary in this communication is not intended to constitute “research” as defined by applicable regulations. Whilst information published on or accessed via this website is believed to be reliable, as far as permitted by law we make no representations as to its ongoing availability, accuracy or completeness. Any quotes or prices used herein are current at the time of preparation. This document and its contents are proprietary information and products of our firm and may not be reproduced or otherwise disseminated in whole or in part without our written consent unless required to by judicial or administrative proceeding. The ultimate decision to proceed with any transaction rests solely with you. We are not acting as your advisor in relation to any information contained herein. Any projections are estimates only and may not be realised in the future.

ASR has no position in any of the stocks mentioned.