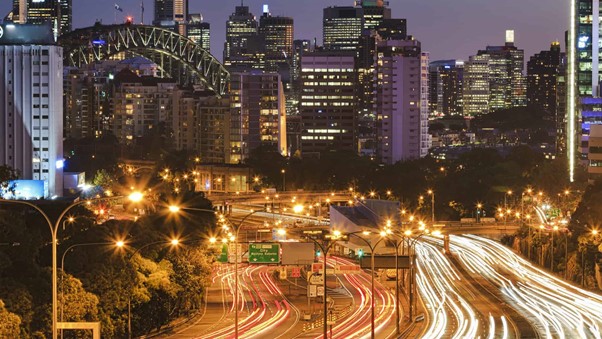

Transurban Group Ltd (ASX: TCL) is a leading toll road owner and operator, with a portfolio of assets in Australia (Melbourne, Sydney and Brisbane), as well as in North America (Greater Washington, United States and Montreal, Canada). Concession lives are fixed, with toll roads handed back to their respective government’s debt-free at the end of the concession period. The weighted average concession life of the portfolio is around 30 years. Toll roads have very high barriers to entry and benefit from rising traffic volumes and tolls, which increase generally in line with movements in the inflation rate as measured by the consumer price index. TCL is a stapled security, with a considerable portion of its net cash flows distributed to security holders pre-tax. TCL has a market capitalisation of A$39 billion.

What are the key features of TCL’s FY21 results?

Average daily traffic decreased by 0.4% in FY21 compared to FY20 (excluding contributions from M8 and M5 East and NorthConnex). Free cash decreased by 13.5% compared to FY20, which was attributed to continued COVID-19 related impacts reducing car usage. Reported net loss (continuing operations) increased by 339.1% to A$256 million (loss). However, reported net profit (discontinued operations) increased by 3,070% to A$3,303 million, which was attributed to a A$3,726 million gain on the sale of Transurban Chesapeake asset. TCL announced a dividend of 21.5 cents per share (fully franked). This brings the total FY21 dividend to 36.5 cents per share.

What is the outlook for TCL?

The short-term outlook for TCL remains uncertain due to continued COVID-19 lockdowns in Sydney and Melbourne. However, these short-term issues are expected to stop occurring when around 70% of the Australian and United States population is vaccinated, which should stop lockdowns from occurring. The long-term outlook for TCL is positive because of the reliance on car transportation in Australia and United States and long-life projects should allow for strong predictable cash flows. In addition, the M8/M5 East and NorthConnex opened during the year, which adds to TCL already strong asset base.

What is the market reaction to TCL FY21?

The market reaction to TCL is positive. TCL share price is down 1.7% and is currently trading at A$14.06. TCL has an annual dividend yield of 2.5%.

Disclaimer:

This article has been prepared by the Australian Stock Report Pty Ltd (AFSL: 301 682. ABN: 94 106 863 978)

(“ASR”). ASR is part of Amalgamated Australian Investment Group Limited (AAIG) (ABN: 81 140 208 288 Level 13, 130 Pitt Street, Sydney NSW 2000).

This article is provided for informational purposes only and does not purport to contain all matters relevant to any particular investment or financial instrument. Any market commentary in this communication is not intended to constitute “research” as defined by applicable regulations. Whilst information published on or accessed via this website is believed to be reliable, as far as permitted by law, we make no representations as to its ongoing availability, accuracy or completeness. Any quotes or prices used herein are current at the time of preparation. This document and its contents are proprietary information and products of our firm and may not be reproduced or otherwise disseminated in whole or in part without our written consent unless required to by judicial or administrative proceedings. The ultimate decision to proceed with any transaction rests solely with you. We are not acting as your advisor in relation to any information contained herein. Any projections are estimates only and may not be realised in the future.

ASR has no position in any of the stocks mentioned.