The real estate industry is characterised by cumbersome processes around the purchase and sale of real property that have remained largely unchanged for decades, especially property settlements that are slow and inefficient and involve the physical presence of parties for the manual exchange of cheques, title deeds and other documents.

Up until now, the real estate industry has relied on various parties to come together - buyer and seller, their banks and lawyers, plus the real estate agent and government agencies (titles office, revenues office, local councils), all using disparate systems. All parties need their systems to talk and to establish trust and transparency. While most organisations have built up systems over the years to try to do this somewhat efficiently it has only achieved moderate success, with significant manual intervention still required to complete a property transaction, especially across borders where trust is lower.

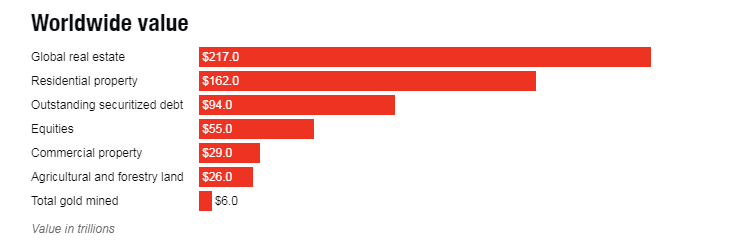

The potential for technology in the real estate industry, and in particular blockchain, corresponds to the huge size of the industry; with a worldwide value of US$217 trillion for all real estate sectors combined.

Source – Hristo Georgiev as published in Hack, medium.com – 29 August 2018.

Blockchain technology and what it means for the property sector

Blockchain is a technology that has the potential to significantly change the way business is conducted and how transactions are effected across an extraordinary range of industries; including property.

Essentially, the core technology innovation is the ability to transact business over the internet without the involvement of a trusted third party such as a bank. The technology uses a distributed ledger known as a blockchain and cryptography to maintain a tamper-proof record of ownership of electronic cash.

While Bitcoin is blockchain’s most famous incarnation and how it came to widespread attention, digital currencies still have a long way to go before they gain mainstream acceptance. However, permission systems using Distributed Ledger Technology (DLT) are being rolled out by large and established businesses worldwide. Some big Australian and global companies currently implementing blockchain solutions for their service delivery include British Airways, FEDEX and Maersk. Australia’s own ASX is working on a blockchain-based replacement for its CHESS system with a ‘go-live’ date of April 2021.

Blockchain facilitates improved trade and commerce transactions while managing risk and reducing the cost of doing business. Its application to an almost endless array of industries, asset classes and business scenarios is a potential game-changer for the way business is transacted.

So, how can blockchain benefit the property industry? The main potential for blockchain in the real estate industry is to increase both the efficiency and the security of real estate transactions - by vastly reducing transaction times and potential for fraud and theft, especially in the transfer of money, titles and data - and to multiply the array of potential ownership structures, including fractional ownership.

Real estate platforms

As property investors would well know, information about property listings is spread across multiple non-standard platforms, leading to search inefficiencies in finding the ideal residential, commercial or industrial property, especially across international borders, and sometimes even state borders.

A blockchain-based decentralised property record system (distributed ledger) would enable faster and more efficient property discovery as data would be distributed across a peer-to-peer network in a manner that allows agents and property brokers to have more control over their data, while promoting increased trust between parties because of the integrity of underlying data about the properties.

Title records

Title deeds are another challenging aspect of the current real estate buying and selling process. Even in the digital age, title information largely remains stored at a local level and is generally offline despite the start of digitisation of titles. Blockchain can offer a new and more efficient way to deal with titles via a central titles database that would securely store and instantly access historical title records, allowing for significant streamlining of title transfer in property transactions.

Financial transactions

Buying, selling or renting property involves costs. There are professional fees and commissions, inspections costs, registration fees, loan fees, and taxes (including significant stamp duty in Australia) associated with real estate. These costs vary according to state legal jurisdiction.

Property payments and transactions are currently done via banks and other intermediaries are slow and expensive, especially across borders where the trust needs to be established, whereas blockchain provides the potential for fast, secure and cheap cross border transactions.

Contracts, settlements. cash flow management

Blockchain facilitates what is known as smart contracts to more easily and efficiently manage the myriad of transactions, checks and verifications involved in buying or renting real estate, not to mention the accounting and reconciliation complexity, especially in commercial real estate. All this has the potential to be managed in near real-time with superior accounting reconciliation in the blockchain.

‘Fractional property ownership’ - the future of property investing

Technology is already providing an innovative way to transact and invest across many industries and sectors. Besides facilitating more efficient transactions, blockchain can allow for real estate to become more liquid because of the potential to facilitate property tokenisation that allows for ease of fractional ownership.

Fractional investing is particularly suited to property investors seeking to diversify investment portfolios across multiple properties or for those with limited funds looking for exposure to the property market. It can also provide a foothold into the property market for younger homebuyers unable to afford the purchase of an entire property.

A seller doesn’t need to wait for a buyer who can afford the whole property in order to get some value out of their property. With property tokenisation and fractional investment, barriers to real estate investing are being lowered.

Technology has the potential to substantially improve efficiency in the real estate industry. Better outcomes include improved and more accessible information and data sharing, faster yet more secure settlements, money and title transfers, reduced risk of fraud and theft, and more efficient property management processes. In short, a faster yet more secure and trusted process for buying, selling and managing property that benefits all participants.

By George Paxton – Non-executive Director of DomaCom and Executive Director of aaig

DomaCom is a leading facilitator of fractional investing in Australia. It owns and operates a fractional investment platform that provides an innovative opportunity for the SMSF market and other long-term investors to invest in fractions of a range of assets including property, mortgage-backed securities and debt securities via a unique trust structure. HALO Technologies, which is part of the aaig Group of companies, has recently acquired a strategic holding in ASX listed DomaCom.

Disclaimer:

This article has been prepared by the Australian Stock Report Pty Ltd (AFSL: 301 682. ABN: 94 106 863 978)

(“ASR”). ASR is part of Amalgamated Australian Investment Group Limited (AAIG) (ABN: 81 140 208 288 Level 13, 130 Pitt Street, Sydney NSW 2000).

This article is provided for informational purpose only and does not purport to contain all matters relevant to any particular investment or financial instrument. Any market commentary in this communication is not intended to constitute “research” as defined by applicable regulations. Whilst information published on or accessed via this website is believed to be reliable, as far as permitted by law, we make no representations as to its ongoing availability, accuracy or completeness. Any quotes or prices used herein are current at the time of preparation. This document and its contents are proprietary information and products of our firm and may not be reproduced or otherwise disseminated in whole or in part without our written consent unless required to by judicial or administrative proceeding. The ultimate decision to proceed with any transaction rests solely with you. We are not acting as your advisor in relation to any information contained herein. Any projections are estimates only and may not be realised in the future.

ASR has no position in any of the stocks mentioned.