Stanmore Coal Ltd (ASX: SMR) is an Australian midtier metallurgical (also known as coking) coal miner (market capitalisation is around $290M). The firm owns and operates the Isaac Plains mine, located in Queensland’s Bowen Basin (where many other coal mines operate). Unlike thermal coal (lower quality coal used primarily for power generation), coking coal is used to produce steel. Around half of Stanmore’s production is exported to Japan and Korea. Europe and India are counted as other key export markets for the firm.

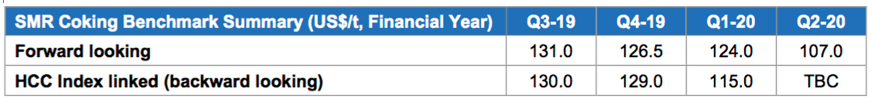

In its recent September quarterly update, Stanmore guided full-year production of 2.35M tonnes at a cost of $100/tonne. This is comfortably below the forward-looking benchmark for coking coal, indicating that Stanmore can maintain its strong free cash flow generation. The firm is investing in mine upgrades and other methods to achieve efficiency gains to weather a downturn in coal prices (as is forecast from Q2-20).

Stanmore gave half-year EBITDA guidance of $53M to $56M and currently holds $90.7M of cash (with no debt). After taking out Stanmore’s large cash balance and annualising the firm’s EBITDA guidance, the firm trades at a very low multiple of 1.8X EV/EBITDA. This valuation represents a 40% discount to some of its larger peers. For example, Whitehaven Coal (ASX: WHC) and New Hope Corp (ASX: NHC) trade 5.6X and 4.5X respectively. Unlike Stanmore, these firms also do not have a large, buffering cash position.

Stanmore’s management is operationally focussed. The General Manager of Operations, Bernie O’Neill, was the Former GM of Glencore’s Newlands/Collinsville Coal, while Interim CEO, Jon Romcke, was the Former Head of Iron Ore assets for Glencore International.

Many investors question the long-term viability of coal as an investable commodity. Unlike thermal coal, coking coal is a necessity to allow for continued global progress, particularly in developing economies. There is currently no widely used replacement for steel in the construction and manufacturing sectors, supporting Stanmore’s revenue stream. It appears harsh to paint all public coal companies with the same scathing brush when the companies that produce large quantities of thermal coal (Whitehaven Coal and New Hope Corp included) arguably face much stiffer headwinds than Stanmore Coal.

Offering a trailing yield of around 10%, Stanmore could be an important part of a diversified income-focussed portfolio (although the dividend could fall in future as the firm’s mine life becomes shorter).

Disclaimer:

This article has been prepared by the Australian Stock Report Pty Ltd (AFSL: 301 682. ABN: 94 106 863 978)

(“ASR”). ASR is part of Amalgamated Australian Investment Group Limited (AAIG) (ABN: 81 140 208 288 Level 13, 130 Pitt Street, Sydney NSW 2000).

This article is provided for informational purpose only and does not purport to contain all matters relevant to any particular investment or financial instrument. Any market commentary in this communication is not intended to constitute “research” as defined by applicable regulations. Whilst information published on or accessed via this website is believed to be reliable, as far as permitted by law, we make no representations as to its ongoing availability, accuracy or completeness. Any quotes or prices used herein are current at the time of preparation. This document and its contents are proprietary information and products of our firm and may not be reproduced or otherwise disseminated in whole or in part without our written consent unless required to by judicial or administrative proceeding. The ultimate decision to proceed with any transaction rests solely with you. We are not acting as your advisor in relation to any information contained herein. Any projections are estimates only and may not be realised in the future.

ASR has no position in any of the stocks mentioned.